In the tapestry of our lives, two fundamental threads weave together to shape our overall well-being: our physical health and financial stability. The convergence of these realms has birthed a revolutionary concept known as BioFinTech. As technology continues its rapid march forward, BioFinTech takes center stage, promising to redefine how we approach health and finance. In this captivating exploration, we will delve into the vast implications of BioFinTech, shedding light on its transformative power to revolutionize our lives and reshape the very fabric of our society.

The Crucial Interplay between Biological and Financial Health:

It is an undeniable truth that our biological health and financial well-being are intrinsically linked, forming two sides of the same coin. When our biological health falters, we are thrust into a whirlpool of medical expenses, loss of income, and financial strain. Conversely, robust financial health serves as a safety net during unexpected health crises, alleviating the stress and enabling a smoother recovery. Yet, financial struggles can have a detrimental impact on our physical and mental well-being, making it challenging to maintain good financial habits and exacerbating existing health conditions. The symbiotic relationship between our biology and finances underscores the paramount importance of BioFinTech in fostering holistic well-being.

BioFinTech Interventions: Pioneering a New Era of Tech-Mediated Health & Finance:

BioFinTech’s rise has ushered in a wave of innovative interventions designed to improve health outcomes while simultaneously addressing financial well-being. These groundbreaking initiatives are poised to transform the landscape of health and finance, offering a multitude of benefits to individuals and society as a whole. Let us delve into some of the transformative BioFinTech interventions that hold the potential to reshape our lives:

Wellness Programs with Financial Incentives: In an era where prevention is key, wellness programs that leverage financial incentives have emerged as powerful motivators for healthy behavior. By offering rewards and incentives for adopting and maintaining a healthier lifestyle, individuals are motivated to make positive choices that benefit both their physical well-being and financial stability.

Telemedicine Platforms: The rapid advancement of technology has unlocked new avenues for accessible healthcare services. Telemedicine platforms, accessible from the comfort of one’s home, enable individuals to connect with healthcare professionals remotely. This revolutionizes healthcare accessibility, particularly for those residing in remote areas or facing mobility constraints. By providing convenient and timely medical assistance, telemedicine platforms empower individuals to prioritize their health while minimizing financial burdens associated with traditional in-person care.

Health-Integrated Financial Planning Tools: The emergence of health-integrated financial planning tools marks a significant milestone in the BioFinTech landscape. These innovative tools seamlessly weave health considerations into financial planning, enabling individuals to make informed decisions that account for their unique health needs. Whether it’s estimating future medical expenses, budgeting for health-related emergencies, or navigating insurance options, these tools empower individuals to build a solid financial foundation while ensuring their health needs are adequately addressed.

Health Implications of BioFinTech: Unveiling the Pros and Cons:

As with any transformative innovation, the utilization of BioFinTech brings forth a myriad of health implications, both positive and negative. Understanding these implications is crucial for harnessing the full potential of BioFinTech while proactively addressing its challenges. Let us explore the key health implications associated with BioFinTech:

Positive Health Implications:

Enhanced Access to Healthcare Services: One of the most significant advantages of BioFinTech is its potential to expand access to healthcare services. By leveraging technology and data integration, BioFinTech interventions facilitate individuals’ access to advanced medical services, specialist consultations, and specialized treatments. This enhanced accessibility can significantly improve health outcomes and empower individuals to take proactive measures towards their well-being.

Holistic Approach to Well-being: BioFinTech interventions strive to address both health and financial needs simultaneously. This holistic approach recognizes the intricate interplay between physical health and financial stability, fostering overall well-being. By alleviating financial stressors and offering personalized health guidance, BioFinTech interventions have the potential to enhance individuals’ quality of life, reducing the burden on their physical and mental health.

Negative Health Implications:

Privacy and Security Concerns: The collection and utilization of personal health and financial data raise legitimate concerns regarding privacy and security. Safeguarding sensitive information becomes paramount to ensure individuals’ trust in BioFinTech interventions. Measures must be taken to establish robust data protection protocols, mitigate the risk of data breaches, and provide individuals with full control over their information.

Equitable Access to BioFinTech Interventions: While BioFinTech holds tremendous potential, ensuring equitable access to these interventions remains a critical challenge. Economic disparities can hinder individuals from benefiting from the technological advancements offered by BioFinTech. Efforts must be made to bridge the digital divide, ensuring that economically disadvantaged populations have equal access to the resources, technologies, and opportunities offered by BioFinTech.

The Emergence of Health Credit Scoring: Pioneering Financial Wellness:

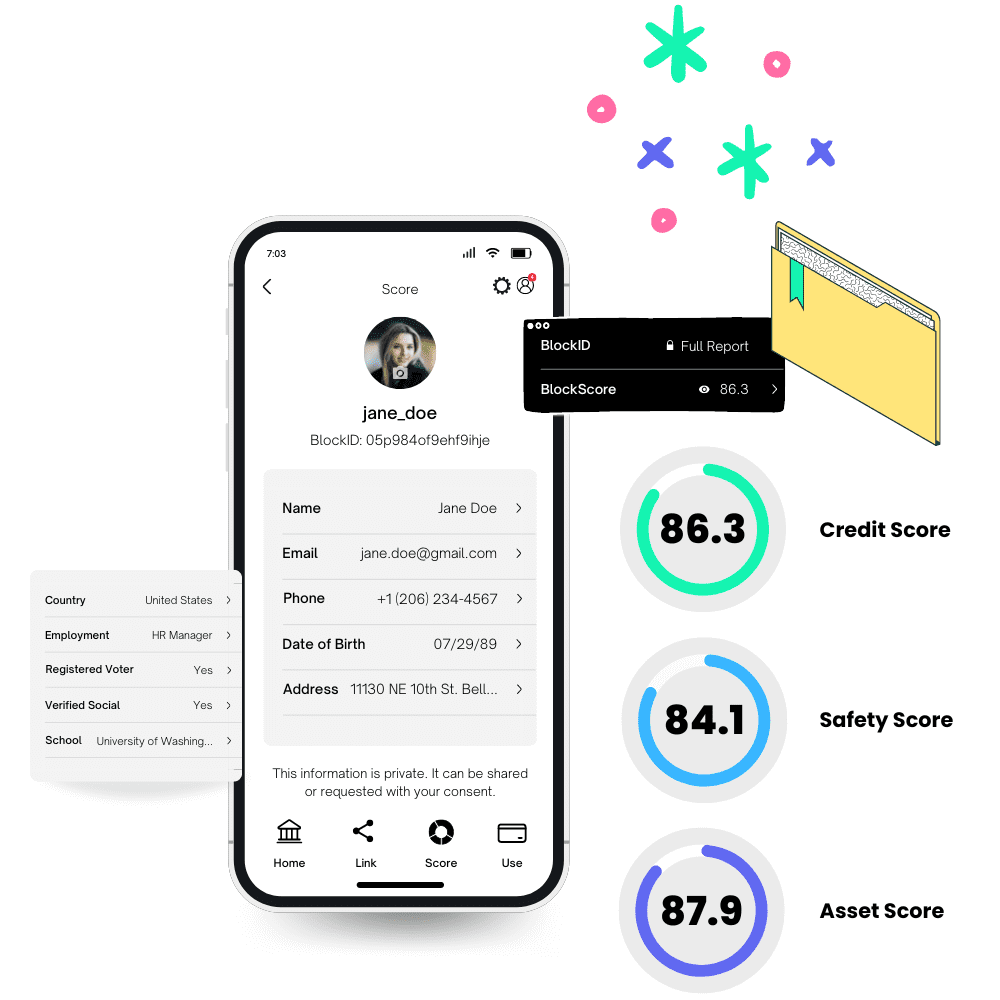

A groundbreaking aspect of BioFinTech is the emergence of health credit scoring—a revolutionary concept that empowers individuals to evaluate their health and financial prospects. Similar to traditional credit scoring, health credit scoring leverages comprehensive health data to provide individuals with an accurate assessment of their overall well-being. This newfound understanding of their health enables individuals to make informed decisions, embark on personalized health journeys, and take proactive steps towards maintaining optimal health.

FreshCredit, a leading proponent of BioFinTech, stands at the forefront of implementing health credit scoring in practical applications. By harnessing the power of data, FreshCredit offers users a unique platform to opt in or out of clinical trials, access personalized medical information, and participate in health research. Through integration with platforms like clinicaltrials.gov, FreshCredit provides users with tailored recommendations for clinical trials based on their specific health conditions, ensuring they remain informed about potential opportunities for medical advancements and interventions.

Furthermore, FreshCredit’s API access to major electronic medical record (EMR) providers and government EMRs unlocks unparalleled opportunities for data analysis and health scoring. Similar to credit scoring models, health credit scoring evaluates an individual’s health status, risk factors, and medical history, enabling them to gain valuable insights into their well-being. This dynamic analysis allows users to navigate healthcare options with confidence, make informed decisions about their treatment and preventive care, and chart a path towards a healthier future.

Genetic Insights and the Future of BioFinTech and “Health Credit”:

FreshCredit’s visionary approach extends beyond traditional health data, incorporating genetic insights into the health credit framework. By integrating API data from reputable genealogy sites like 23andMe, FreshCredit pioneers a genetic credit system, revolutionizing how individuals understand their health and make informed decisions. This genetic credit system quantifies the genetic basis for diseases, empowering individuals with personalized medical guidance, treatment options, and secondary benefits that transcend mere scoring.

Unlocking the Value of Personal Data:

FreshCredit’s groundbreaking platform acknowledges the value of personal data and offers users an opportunity to unlock its potential. Through commercial payment for scanning and utilizing personal data, such as genomic information, FreshCredit not only provides services but also enables users to monetize their data. This transformative approach ensures that individuals retain ownership of their data while benefiting from its usage, promoting a fair and mutually beneficial ecosystem.

Addressing the Emotional and Psychiatric Impact:

Beyond the tangible aspects, BioFinTech’s impact extends into the realm of emotions and psychiatric well-being. The ramifications of “lack of credit” or “poor credit” can be profound, leading to feelings of exclusion, stress, and anxiety. The current credit system, flawed as it may be, plays a significant role in shaping individuals’ financial and emotional experiences. By providing a comprehensive platform like FreshCredit, more people can gain access to opportunities to build credit, creating a robust system that generates better data and self-refinement. This not only empowers individuals financially but also alleviates the emotional burden associated with limited credit opportunities.

Unveiling the Flaws of the Current System:

The impact of significant life events on credit and the ensuing feedback loop is a well-documented phenomenon. Unfortunately, marginal credit populations often find themselves caught in a cycle where vendors are unable to make informed risk-based decisions, further exacerbating their financial struggles. FreshCredit’s transformative platform disrupts this cycle, empowering individuals to rebuild their credit while generating comprehensive data that fuels self-improvement and risk assessment.

The Alarming Reality: “No Credit, No Care”:

One cannot discuss the intersection of health and finance without addressing the stark reality encapsulated in the phrase, “No credit, no care.” The United States, renowned for its advanced medical care, paradoxically excludes many individuals from participating due to their credit status. This systemic flaw in the healthcare system perpetuates health disparities, poor overall outcomes, and potentially higher rates of death and disease. FreshCredit, along with its innovative offshoot technologies and use cases, offers a beacon of hope—a transformative solution that aims to mend the “health of the system” by revolutionizing the “healthcare system.”

BioFinTech represents a remarkable convergence of biological health, financial well-being, and cutting-edge technology. As this field continues to evolve and advance, it is imperative to monitor its impact on health and finance, ensuring that interventions are designed with privacy, security, and equity in mind. By addressing the concerns surrounding data privacy, bridging the digital divide, and fostering equitable access, BioFinTech can truly revolutionize our lives, providing individuals with the tools, insights, and opportunities to thrive both physically and financially.

The journey towards a future where health and finance seamlessly intertwine begins with the innovative spirit of BioFinTech, and FreshCredit stands at the forefront, spearheading this transformative movement. Together, let us embrace this paradigm shift and unlock a world where health and financial well-being intertwine for the betterment of all.