The Fresh Protocol

A cross-chain, heterogeneous, algorithmic credit reporting, scoring, and lending protocol for centralized and decentralized applications.

Version 3.0

Author Devon Shigaki

Copyright © All Rights Reserved 2022

Abstract

Centralization of consumer data has led to corporate hacks, creating an environment for fraud, leading to inaccurate and unverified credit data. This security issue can quickly become a class-action lawsuit if bad enough, resulting in a more fragmented data pool. Fragmented data creates a market of competition instead of innovation, and innovation without adoption is only invention. Companies cannot adopt better ideas and policies if data sources become even more siloed off, but we cannot have companies harvest user data for profits at the risk of the consumer. We have a solution.

This whitepaper will introduce a global, decentralized credit scoring and lending protocol. This protocol addresses these concerns and existing limitations by moving the credit reporting and scoring process onto the blockchain. The Fresh Protocol is designed to provide a standardized and composable credit reporting and scoring protocol to simultaneously reduce consumer and business risk, scale the benefits of credit scoring globally, and interoperate with decentralized and centralized applications.

The Fresh Protocol is a programmable ecosystem allowing both fiat and digital asset lenders to issue compliant loans utilizing a standardized modular framework that is a compliant and composable risk assessment process on a deployable on a global scale while increasing the competition to lower fees and improve the borrower experience reducing the barrier for entry.

The Fresh Protocol provides solutions for some of the most complex problems currently thwarting global economic growth and commerce. Issues include cross-border credit scoring, credit drift, regulatory compliance, identity theft, defaults, and consumer entry barriers because of a lack of financial data and credit scoring infrastructure.

Table of Content

- Abstract

- Table of Contents

- Background – Problems

- Why Do Credit and Lending Fail and Work?

- Control and Privacy of Personal Data

- Fair and Inclusive Scoring System

- Access to Valuable Financial Tools

- The Blockchain Trilemma

- Network Security

- Decentralization

- Scalability Regarding TPS

- Why Is Big Data Is Not Valuable?

- Misunderstanding Data

- Data Fragmentation

- Ethical Data Practices

- Why Do Credit and Lending Fail and Work?

- Overview

- Introduction – Solution

- Why use an NFT? – Control and Privacy

- Ownership of Data

- Legal Liability

- Control of Data

- Why use a blockchain? – Fair and Inclusive

- Compatible – Secure Network

- Composable – Modular Framework

- Compliant – Scalable Infrastructure

- Why use a DAO? – Access to Value

- Efficiency

- Security

- Compliance

- Why use an NFT? – Control and Privacy

- Protocol Overview

- Protocol Components

- The BlockID dNFT

- The BlockScore Blockchain

- The BlockIQ DAO

- Architecture

- BlockID® dNFT – Control and Privacy

- Sovereign Financial Identity and Data Control

- Identity Validators

- Reporting Format

- Share Report

- Tamper-Proof Reporting

- Implementing FCRA Compliance

- IPFS Storage Cost

- Handling Bad Actors and Spam Accounts

- BlockScore® Protocol – Fair and Inclusive

- Oracles – External Influences

- Economic Data

- Supply-chain Data

- Private APIs – Consumer Data

- Centralized Financial Data

- DeFi Financial Data

- Credit Bureau Data

- Social Network

- Digital Footprint

- What Is a Good Score

- What Makes A Bad Score

- Finances – Financial Data

- Digital Assets – Crypto, NFTs, Metaverse, IoT Devices

- Assets – Traditional Investments

- Liquidity – Cash Reserve

- Reliability Score – Consumer Behavior

- Payment History

- Loan Activity

- Total Debt

- Verified Public Records

- Social Score – Public Identity

- Facebook Verified

- Twitter Verified

- Linkedin Verified

- Digital Footprint

- Scoring Algorithms

- Methodology

- Scoring Factors

- Crypto Wallet (score cap)

- Crypto Wallet w/ Social KYC (score cap increase) optional

- Crypto Waller w/ Financial KYC (score cap lifted) optional

- Public Data Asset API

- Oracles – External Influences

- The BlockIQ® DAO – Access to Value

- The Value of BigData

- Leveraging the Value of Big Data

- Autonomous Lending Pool

- The Economics

- Stimulating Real vs. Financial GDP

- Token Dynamics

- Utility

- Unit of Account

- Remittance and Settlement

- Transaction Bridge

- Network Rewards

- Tokenomics

- Stimulative Model – No Cap

- Organic Growth of Network Data

- Staking and Lending – Earn Tokens

- Staking and Borrowing – Use Tokens

- Default Risk Parameters – Securing The Network

- Interest and Loan Terms

- Liability

- Security – Shared Network Security

- Compliance – No Token Sale/ICO – Located In Wyoming, and Puerto Rico

- Utility

- BlockID® dNFT – Control and Privacy

- Conclusion

- Roadmap

- Phase 1 – Licensing

- Phase 2 – Infrastructure

- Phase 3 – Secure IP

- Phase 4 – Proof of Concept

- Phase 5 – 409A FMV

- Phase 6 – Develop BlockID dNFT

- Phase 7 – Develop BlockScore Blockchain

- Phase 8 – Develop BlockIQ DAO

- References

- Disclaimer

Background

Why Do Credit and Lending Work and Fail?

To understand what is coming at you, you need to understand what happened before you. Truth is the essential foundation for providing good outcomes. Truth is the reality of how things work, which is hyper-realism, a necessary component of building big dreams.

Transactions

- An economy is the sum of all transactions

- A transaction is created every time you buy something

- Every transaction has a buyer using money or credit to buy goods, services, or assets from a seller

- The total amount spent drives the economy

- Transactions drive all cycles in all economies

Credit

- Credit is the most important part of the modern economy, and probably the least understood.

- Credit is the biggest and most volatile market, 300% bigger than equities and derivatives.

- Credit helps both lenders and consumers get what they want.

- Credit spends just like money.

- When a borrower spends credit, it also drives the economy because one person’s spending is another person’s income.

- When credit is spent, it becomes debt.

- Debt becomes an asset for the lender and liability for the consumer.

Economic Drivers

Productivity matters the most in the long term, but credit matters the most in the short term. Productivity growth does not fluctuate much as a driver of economic swings, but debt is because it allows us to consume more than we produce and forces us to consume less than we produce when we have to pay it back. It is naturally inflationary and deflationary.

Credit, not innovation, is the driving force of the economy. Credit itself sets into action a series of events making credit very different from money. Money is what you settle a transaction with, and most of what people call money is credit. The United States leverages $50T in credit with $3T in cash.

An economy without credit will have a very hard time keeping up with the rapid development of the digital economy. Credit is bad when it finances overconsumption that is not paid back. When used to efficiently allocate resources, reduce fraud, and produce income, it can help create a safer, transparent, inclusive economy for everyone.

Economic Controller

Because credit does not require collateral, implementation can happen in minutes. When credit is available, economic expansion is possible. When credit is not available, we experience recession primarily controlled by the central bank to circumvent a depression.

The relationship between the central banks and the central governments was the most democratized framework available till recently. The central banks were purposefully private so that the government would not abuse their power. The central bank has limitations where the central government has the authority to balance the power of each entity.

Deleveraging works one of four ways.

- Cut Spending – Kills Income Killing the Economy (deflationary)

- Reduce Debt – Run On The Banks (deflationary)

- Increase Spending – Income and Assets Drop in Value, Exploding the Deficit (deflationary)

- Print Money – Central Can Only Buy Financial Assets, Only helping people holding financial assets. (inflationary)

Printing money will not cause inflation if it offsets falling credit. In fact, this is the main purpose of printing money, but what if we could issue a line of credit instead of printing money. Could we avoid the risk of an inflationary spike and possible spiral downward while increasing the entire global bond market by 96%?

The central bank is able to lend out money at almost 0% interest, meaning if we can generate more interest for the users of a global bond/credit market, we could remove defaults, reducing debts by taking from the rich to giving to the poor, using the interest generated by the value of the pool to supplement loan payments, meaning given enough time every loan will eventually be paid, stabilizing the long-term bond market.

Order within society and low corruption is the formula for progress. By developing the bond, equities, and derivatives markets, people will be able to leverage their savings and assets to invest in innovation and share in the success of their economy in the safest way possible. Stanford researchers found that implementing credit scores increased the minimal initial downpayment by 42% on all auto loans from one year to the next while dramatically reducing the default rate reaching mass adoption within two years.

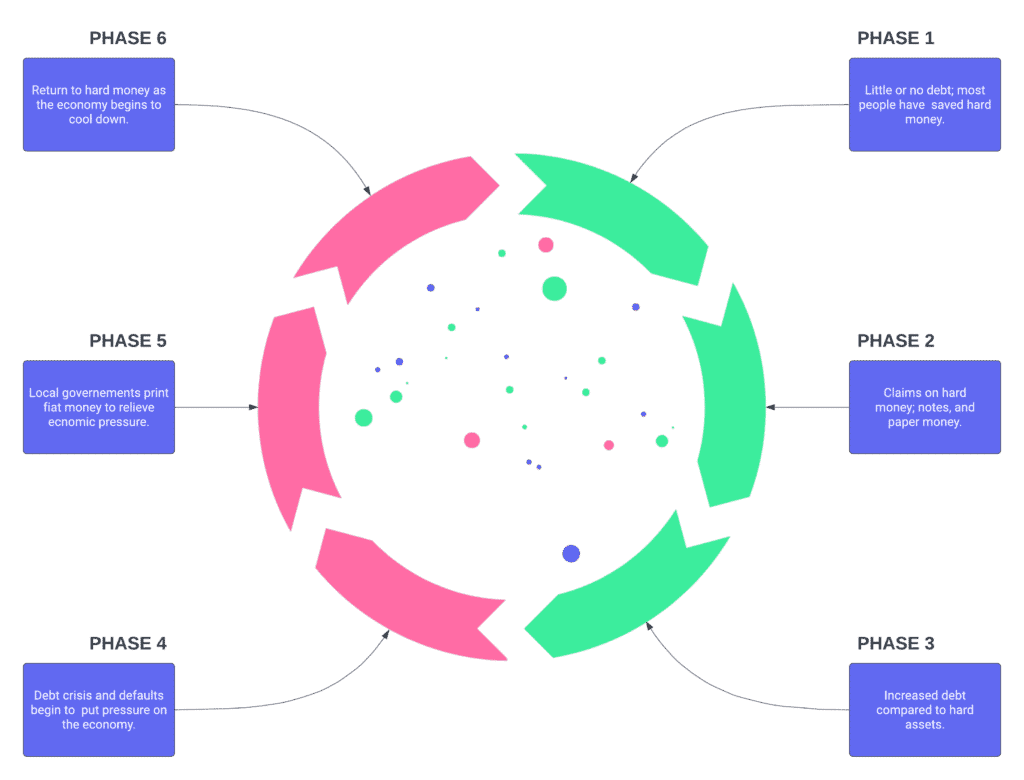

The Order of the Credit and Lending Debt Cycle

- Little or no debt; hard money

- Claims on hard money; notes, or paper money

- Increased debt compared to hard assets.

- Debt crisis and defaults begin.

- The local government creates fiat money.

- Return to hard money.

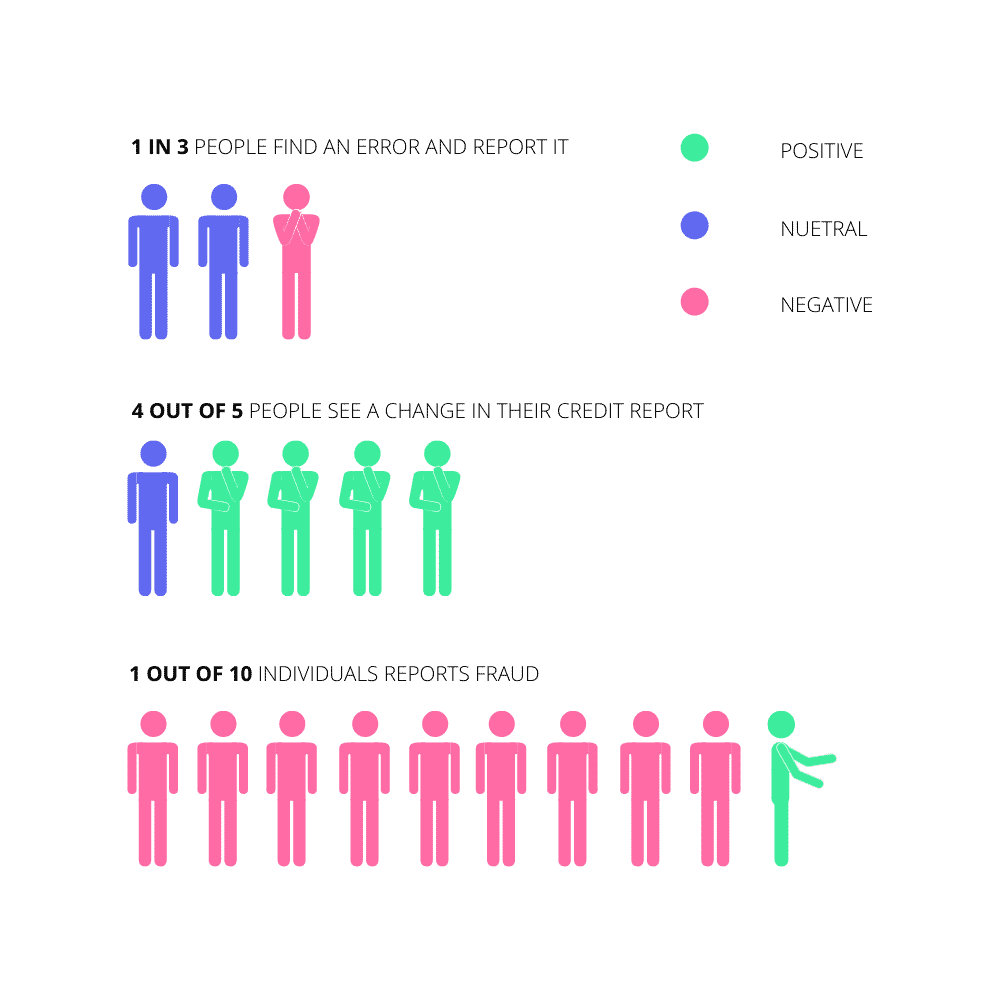

Control and Privacy of Personal Data

The FTC estimates that around 25% of all US credit reports contain at least one error negatively affecting consumers’ credit scores. These issues w/ our current credit reporting, verifying, and scoring protocols have stemmed back to the 1700s. One of the original purposes of a ledger was recording critical financial data and assessing individuals’ credibility using the ledger as a reference. Then bureaus began to form, collecting information allowing organizations to understand consumers’ financial position. These organizations eventually began having significant problems stemming from heated issues regarding sexism, racism, and invasion of personal privacy. This led to the creation of the credit scoring system known as FICO. In 2015 the US declared credit scoring a monopoly controlled by a single organization, FICO, providing credit scoring for more than 90% of the top US lenders. The FICO credit scoring system currently leaves 26 million Americans’ credit invisible and another 19 million unscorable. With the rise of the digital age, the amount of data available has gone parabolic, along with ways to misuse it. A study by Penn State noted multiple ways in which social media data may already be misused for credit scoring in the future if unchecked. Current credit scoring providers cannot operate globally due to a vast majority of cultural, economic, and regulatory compliance differences and requirements. Every country has its own culture, and our culture builds the BlockScore® Network of how we think about, spend, invest, manage, and utilize our wealth and credit. Copy-pasting models directly from matured countries like the US or China will not work.

- Fraud up 38% in 2020, FTC*

- Security Issues w/ Holding BigData*

- Value of BigData, Harvard Business Review*

Fair and Inclusive Scoring System

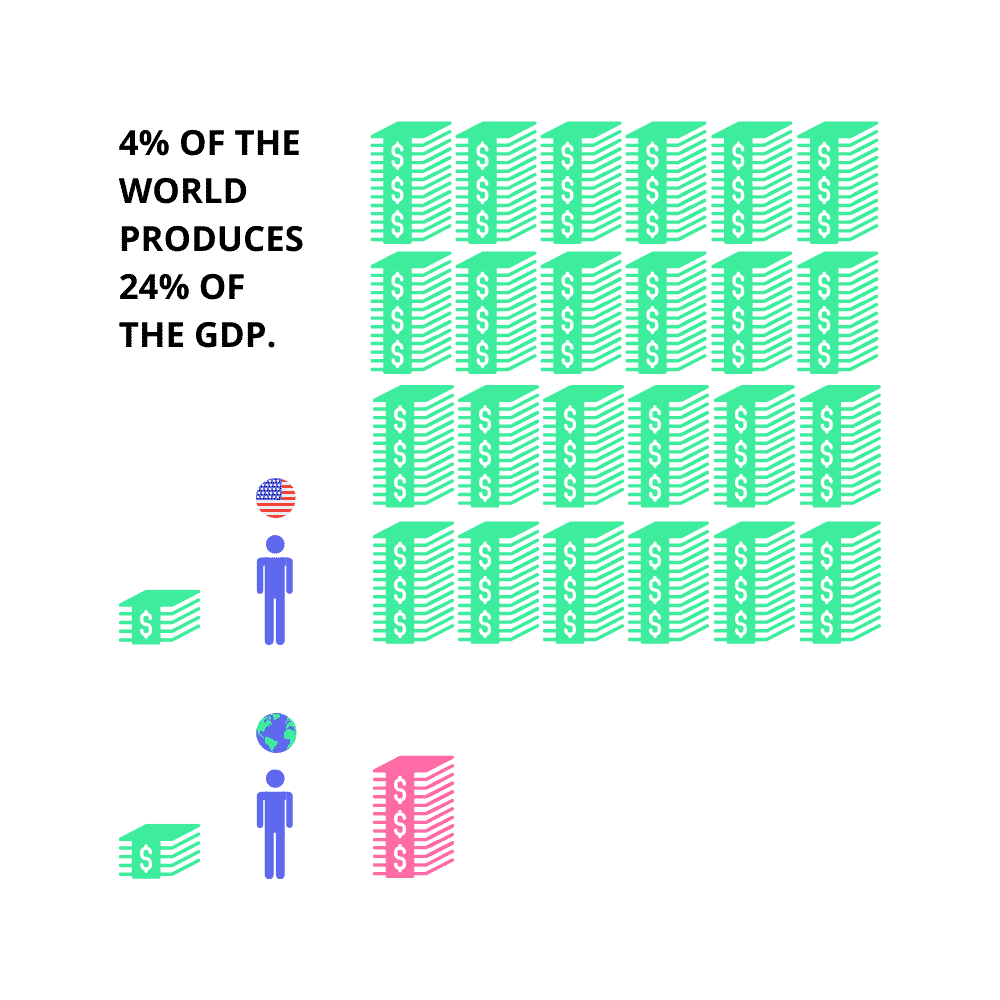

Even with all these issues currently plaguing the United States credit system, we have still managed to become the most powerful financial country on the planet through the deployment of leveraged revolving debt (credit and credit cards). The US alone generates more than 24% of the total GDP using the power of revolving leveraged debt. Most of this spending power is based on risk assessment protocols powered by credit scores, yet the US is only for 4% of the global population. This means we are possibly excluding millions if not billions of creditworthy individuals from the worldwide economy, which could potentially represent hundreds of trillions of dollars added to the total GDP.

- History of Credit Protocols (ledgers, bureaus, scores) – TIME Magazine*

- Discrimination – National Consumer Law*

- Issues w/ Social Network For Credit Scoring – Penn State*

Access to Financial Tools

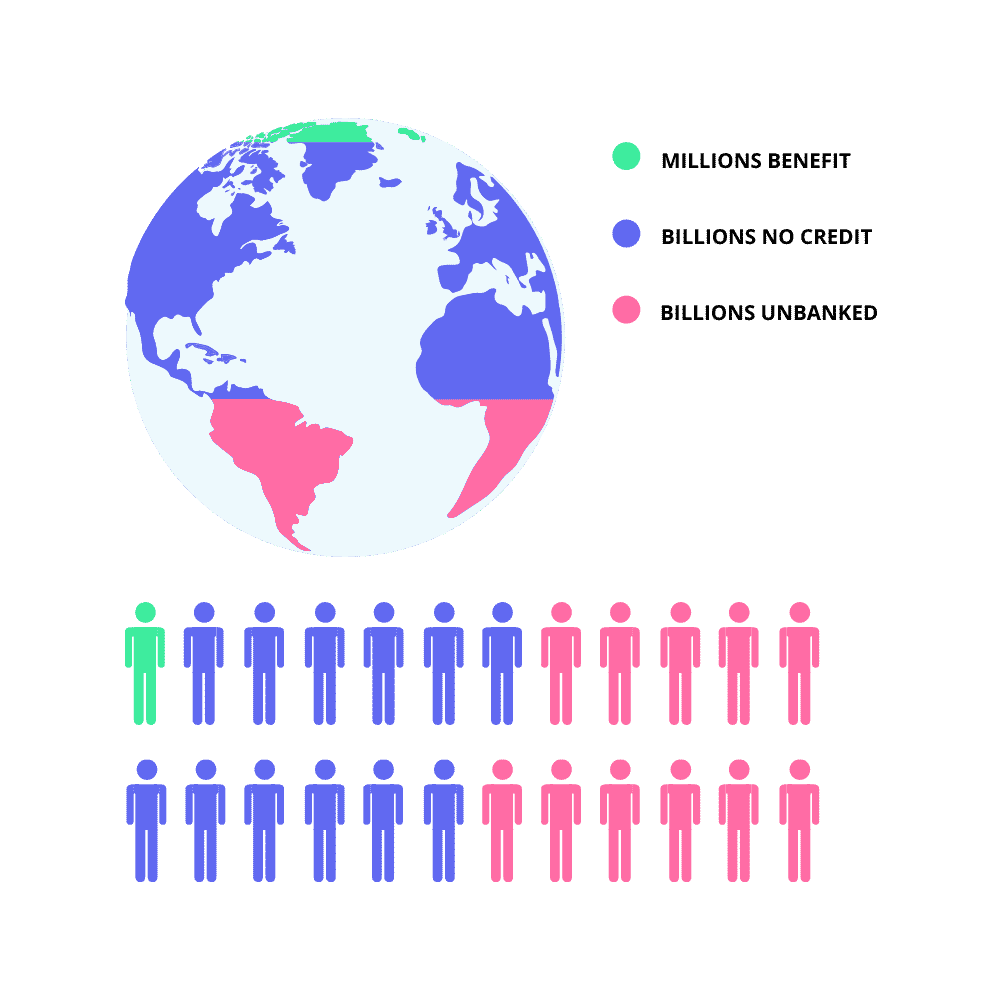

The significant benefits of financial identity and modern credit scoring are not for everyone. Globally billions of individuals are unbanked. Deloitte stated that the penetration of internet access had gained significant traction in the past few years due to mobile smartphones. Before wifi, running physical network lines through certain areas was very difficult. Even if an individual has internet access, many cannot obtain access to financial institutions. According to a study done by Stanford University, one of the main reasons lenders failed to offer to lend to sub-prime borrowers was because of incomplete data, leaving billions more unable to utilize a modern credit scoring system to borrow needed funds. A second study conducted at Standford revealed the direct effect of implementing credit scoring increased the down payments more than 40%, significantly increased overall loan size, and reduced defaults by 15%. Globally over 3 billion people cannot obtain a credit card, and over 90% of the population in developing nations find it difficult to find debt financing options.

- The Unbanked – Deloitte*

- Liquidity Constraints for Subprime Lending w/ Imperfect Information – Stanford*

- Credit Data – Modern Credit Scoring Affect On Lending Down Payments and Defaults- Stanford*

- Defaults 35% of loans default in the 1st year*

What Is The Blockchain Trilemma?

Blockchain technology is proving its broad utility in industries across finance to art, but the underlying structure of decentralized networks comes with unique challenges. Computer scientists developed the CAP theorem-proof to articulate perhaps the most major of these challenges. According to the CAP theorem, decentralized data stores can simultaneously provide only two of three guarantees: consistency, availability, and partition tolerance (CAP). This theorem has evolved into the blockchain “trilemma.” This belief is that public blockchains must sacrifice security, decentralization, or scalability in their infrastructure.

The client-server relationship dominates central network infrastructures like VISA or the internet; public blockchain networks utilize decentralized consensus mechanisms. They manage a distributed network of nodes to achieve data consensus over an infrastructure that is resilient to outside attack while maintaining transparency and equitable, open access.

For example, Bitcoin is decentralized and secure but transacts approximately seven transactions per second (TPS) compared to enterprise blockchains like IBM’s Hyperledger’s, which is secure and can handle high transactional throughput but is also centralized to a highly limited number of consensus-achieving nodes. Blockchains that are decentralized and fast but insecure are vulnerable to hacks.

Understanding programming and its current limitations regarding the layering model such as layer 1 and layer 2 is critical when gauging project viability. Any chain that layers on top of a homogenous blockchain framework, like Ethereum, will fail long term. This is because they fail to solve the CAP theorem-proof, in blockchain known as the “trilemma.” Layering does not solve this issue as it still resides in the core foundational code. Layering slows down network bleed delaying the inevitable—failure to remove the value mechanism related to the internal transactions, for example, simple network communication. Gas fees for every interaction on the layer 2 blockchains like Ethereum is a core technological flaw.

This overall issue then creates dust accounts, wallets with tiny amounts of eth that can’t be pulled out. A layer 1 homogenous chain must account for all the value on the network, including the dust account created from every exchange. Over time, this will compound.

This leads to the issue of infinite computational demand, requiring erroneous amounts of network usage for nothing in return but slow network speeds and high fees. Long-term, this will crash the network. The sheer weight on the network would be like a tree soaked in water breaking under the weight. This can’t be forked out of the code, and it can’t be layered on top of. The design of these early chains is flawed.

The EVM is losing traction every day as blockchain developers move to new technologies. The masses are running at it, but it won’t last. Foundationally Ethereum can’t last. Like a home with a cracked foundation, it cannot be fixed. No patch can ever fix the core issues. The idea this can be fixed is fueled by misunderstandings, and hopes drive this market behavior. Many developers who start a layer 1 or layer 2 project leave for new tech or are building bridges to get off their current blockchain framework as soon as possible.

Smart contracts will never truly enable DApps to function to their full potential. They are calculators programmed to respond, not engineered to actively process. Proactive vs. Reactive. A key difference between smart contracts and parachains is the ability to program timed events. Smart contracts are calculators only able to react when buttons are pushed and only able to solve mathematical equations. The jump from calculators to computers was the ability to create timed events. Proactive applications. Using time is as a factor the first way to build new conditional logics in sequences, AKA creates software and an entire market of other use cases. Getting the software on-chain is similar to getting applications onto the phone. Faster and more intuitive features elevated the entire existence of humanity as a result.

Why Is Big Data Not Valuable?

Individuals cannot securely control and monetize personal data because of ongoing network hacks, leading to fraud and reporting errors. Large organizations collect and harvest data making them targets for hackers. Additionally, because each organization stores the data they collect, their decisions are based on fragmented and incomplete data, leading to mistakes and compounding losses. In a typical day, we produce 2.5 quintillion bytes of data. There are multiple data quality issues in the current data collection landscape, such as incomplete data, unverified data, inaccurate data, and niche-only data. With this framework, much of the data is sourced from a complex network of first, second, and third-party data sources.

The challenge with enterprise data is highly distributed across a vast expanse of variable technologies and data platforms. Digital retail, telecommunications, and social media data are structured similarly. At the same time, enterprise data is in mainframes, ETL tools, virtualization layers, relational databases, BI databases, Merkle tree, cloud networks, transaction databases, and hundreds of other components that have evolved in the last few decades. Coupled with the fact that every application has a different data model, which makes accessing this value with data tools is undermined by the complexity of integrating the data with the associated tech platforms.

This is why most business problems faced are related to distributed data problems with data, value, and analysis hugely distributed across heterogeneous locations, technologies, and individual sources. Nevertheless, we insist on solving this growing distribution problem with the same centralized models of the past. These models work when the data is already in a standard format – something we can see with the new unicorns of social media and digital retailing. We are starting to also see the effects of FinTech and DeFi banking, but not much in the way of insurance, healthcare, and a vast number of other business problem areas.

Realizing the value of data at an enterprise level requires an intricate data integration and normalization of project data across a massively heterogeneous landscape. Without changes to that data mechanism and increasing distribution of the organizational components, the poorer the return or outcome of the related project. As the data grows in complexity, distribution, and dispersion inside and external to the enterprise, it does not justify the considerable system and data integration projects requirements as a prerequisite to data’s value. Doug Laney from Gartner recently pointed out that through 2017 90 percent of Big Data projects will not be leverageable because they will continue to be in siloes of technology or location.

“Data is the new oil.”

The comparison, at the level it is usually made, is surface level. Data is the ultimate renewable resource. Any existing data reserve has not been waiting beneath the surface; data is generated in vast amounts every day. Creating value from data is much more a cultivation process where the data becomes more valuable with nurture and care over time rather than one of extraction or refinement.

Perhaps the “data as oil” idea can stimulate some much-needed critical thinking. The human experience with oil has been volatile; fortunes made, bloody conflicts, and a terrifying climate crisis. As we make the first steps into economic policy that will be as transformative and risky as that of the oil industry, foresight is essential. Just like the oil, we have seen “data spills.” Large amounts of personal data are publically leaked. What are the long-term effects of “data pollution”?

One of the places where we will have to tread most carefully — another place where our data/oil model can be helpful — is in the realm of personal data. Trillions of dollars are being made right now in the world of information through human-generated data. Cookies track our browsing habits; social apps see our conversations with friends; fitness trackers see our every movement and location — all of these things are being monetized. This is deeply personal data, though it is often not treated as such. A similar comparison to fossil fuels in a way: where oil is composed of the compressed organic material, this personal data is made from the compressed fragments of our personal lives, where we can then extract our human experience.

The value of data begins to decline as data homogeneity declines and the resulting cost of extracting insight increases. The components of the solution are not strictly homogenous.

Re-framing data into a human context is critical. There are multiple things we can do to make data more human and, in doing so, generate much more value now and in the long term.

- BigData vs. BigOil – The Economist*

Market Overview

Decentralized finance has seen a significant jump in available market liquidity in the past few years. Still, it is just a tiny percentage of the global lending market compared to centralized finance. DeFi is currently estimated to be around $200 billion in total value locked(TVL) vs. CeFi’s (centralized finance) $25 trillion held by JP Morgan alone. This gap represents the inherent risk perceived by centralized financial institutions.

Even though decentralization has dramatically expanded the promise of an open, trustless ecosystem through the use of blockchain technology by creating an unbias, transparent, and efficient means of exchange, it has yet to be globally adopted by government regulators for many significant reasons. One of the most substantial and impeding factors is a standardized risk assessment based on financial identity. Simply put, no standard credit scoring system.

As there is no standardized risk assessment, leaving the lenders of the DeFi industry are forced to over-collateralize lending offers in an attempt to mitigate the overall network risk. These offers range from 1.5X to 3X the capital lent, increasing the borrower’s risk exposure to the underlying asset.

Combing the perceived risk by centralized financial institutions and the inherent risk to the borrowers in decentralized finance creates a very high barrier for entry, which suppresses the astronomical growth potential decentralized finance offers.

Introduction – Solution

The Fresh Protocol is a multi-layered ecosystem designed to accelerate the ownership economy and simultaneously build a global inclusive credit and lending system allowing users to claim, own, manage, tokenize, and monetize their data utilizing blockchain technology.

Why use an NFT? – Control and Privacy

The BlockID® dNFT is the user’s interface allowing individuals and organizations to interact with and leverage their data. By connecting to the network, users gain instant access to a cryptocurrency wallet, allowing them to leverage the BlockIQ® DAO to control and monetize their most valuable asset, data. When users generate a new cryptocurrency wallet, they create a non-transferable unique dNFT (dynamic NFT) called a BlockID® dNFT. Using the BlockID® dNFT, the user decides which permission-based data the network can use to improve the scoring algorithms. As data is continually added to the network, the individual generates more tokens that serve as receipts for the provided data.

- The Data Revolution – Stanford, NBER*

- NFT Projected Growth 185% $485B by 2026, CAGR*

Why use a blockchain? – Fair and Inclusive

The blockchain network serves as the value-generating layer of the decentralized interoperable ecosystem. The network collects and organizes the user data improving the overall accuracy and efficiency of the globally standardized credit scoring algorithms. Every user can individually manage and control the information they share with the network. This data is made freely available through a public API for any organization to request access for research, production, overall public benefit, Etc. The network is managed through transparent on-chain governance and the BlockScore® Network. This allows the network to expand its alternative data sets, increasing the inclusiveness of the credit and lending industry globally.

Solving the Blockchain Trilemma

The “blockchain trilemma” presents significant challenges for blockchain adoption and solutions emerging. Finding an effective and simultaneous balance between network security, decentralization, and scalability is the holy grail. While the CAP theorem-proof has held true for almost four decades, the implementation of parachains is shifting the paradigm towards decentralized networks that are distributed, secure, and scalable.

The issues regarding layer one and layer two blockchain technologies offering decentralization solutions are the critical factors in deciding to build the Fresh Protocol utilizing the Substrate blockchain framework. The cross-chain capabilities are able to address issues regarding data heterogeneity and fragmentation.

Compatible – Consumers – Secure Network

Compatibility – Rust and wasm (apps consumers use) – JavaScript and C# is what 70% of the digital world is built on. So why use Rust? Rust is the only other contender in the same space, but the major difference is that Rust is safer and faster than JavaScript and C#. What does this mean? That Rust can handle backend and frontend developer needs. Combining Rust with web assembly (WASM), developers can compile Rust to 40+ different programming languages supporting tens of millions of developers out of the box compared. Comparing dev support for Solidity, Ethereum’s smart contract programming language has 150k devs worldwide. Rust was voted the most loved language in a poll taken on StackOverflow 5 years in a row.

- Blockchain Projected Growth $2.2T by 2026, CAGR*

Composable – Developers – Modular Framework

Scalability – Often, scalability often refers to transactions per second (TPS). Understanding the concept of the six degrees of separation, we can hypothesize that by using three parachains, we are already able to reach 1,000,000 TPS. A parachain takes 6 seconds to finalize each block, meaning anyone can transact with anyone else on any other network within 18 seconds. At four parachains, we end up at 100,000,000 TPS and so on each time multiplied by 100 more parachains, and so on. Quickly TPS becomes irrelevant. Scalability is about transitioning with the least time and friction.

- Poll Rust Most Loved language – Stackoverflow*

- Websassembly compiler able to be any language vs. solidity community*

Compliant – Enterprise – Scalable Infrastructure

- Data Is An Asset – IFRS and OECD Standard*

- Rust is the safest and fastest programming language*

Why use a DAO? – Access to Value

The BlockIQ® protocol algorithmically controls the BlockIQ® DAO, allowing users to borrow and loan “stake” the tokens they generate after syncing their data with the network. Users can borrow from the network by staking their BlockID® dNFT to the BlockIQ® DAO liquidity pool, which will leverage the value of the tokens attached to the users BlockID® dNFT. Create a custom contract insuring the loan with the user’s future token earnings as they build up more data if they should ever lapse, removing the risk of loan defaults given enough time. If users want to earn interest on their tokens, they would also stake their BlockID® dNFT to the BlockIQ® DAO.

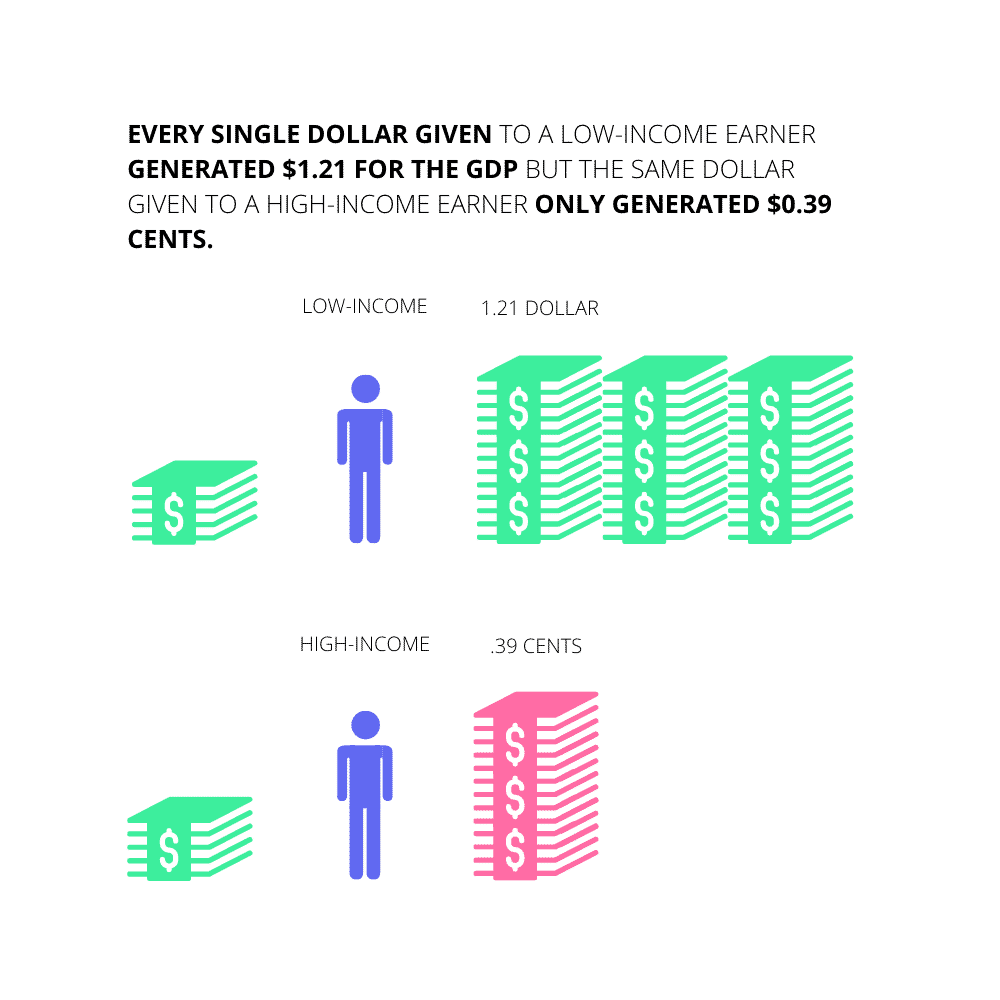

- Give $1 to a Poor vs. Rich effect on GDP – Institute for Policy Studies, New York Comptroller*

- Macroeconomic Effects of UBI $1000 13% GDP Increase – Roosevelt Institute*

- DeFi projects grew 385%, according to DeFi Pulse*

The token serves as the network settlement currency for value flowing in and out of the ecosystem. The token provides the function of identification, security, fractionalization of the entire network value, and remittance for data assets. Once the network validators verify the data, tokens are distributed to the user’s BlockID® dNFT wallet, and validators are rewarded in tokens.

The Fresh Protocol currently has an intellectual patent utilizing parachain technology (interoperable blockchain connecting all other blockchains) to deploy credit scoring algorithms, including real-world assets and digital assets on and off-chain used to adjust the algorithmic risk management protocols regarding lending. (e.g., cryptocurrencies, NFTs, Metaverse assets, IoT devices) will usher in the ownership economy by enabling users to secure, tokenize, and monetize their data while simultaneously building a decentralized, transparent, inclusive credit scoring and lending ecosystem.

As the digital era has paved the way for the most valuable asset, data, and as such, users will increasingly seek a way to retain, protect, and monetize their data. As users develop a sense of ownership, the demand for a fair and transparent system to fulfill these demands becomes ever more apparent. Blockchain technology is the answer to this demand but, in its current state, falls short on four critical aspects delaying mass adoption.

- Credit is Trust – FED, UCLA, Brookings Institution*

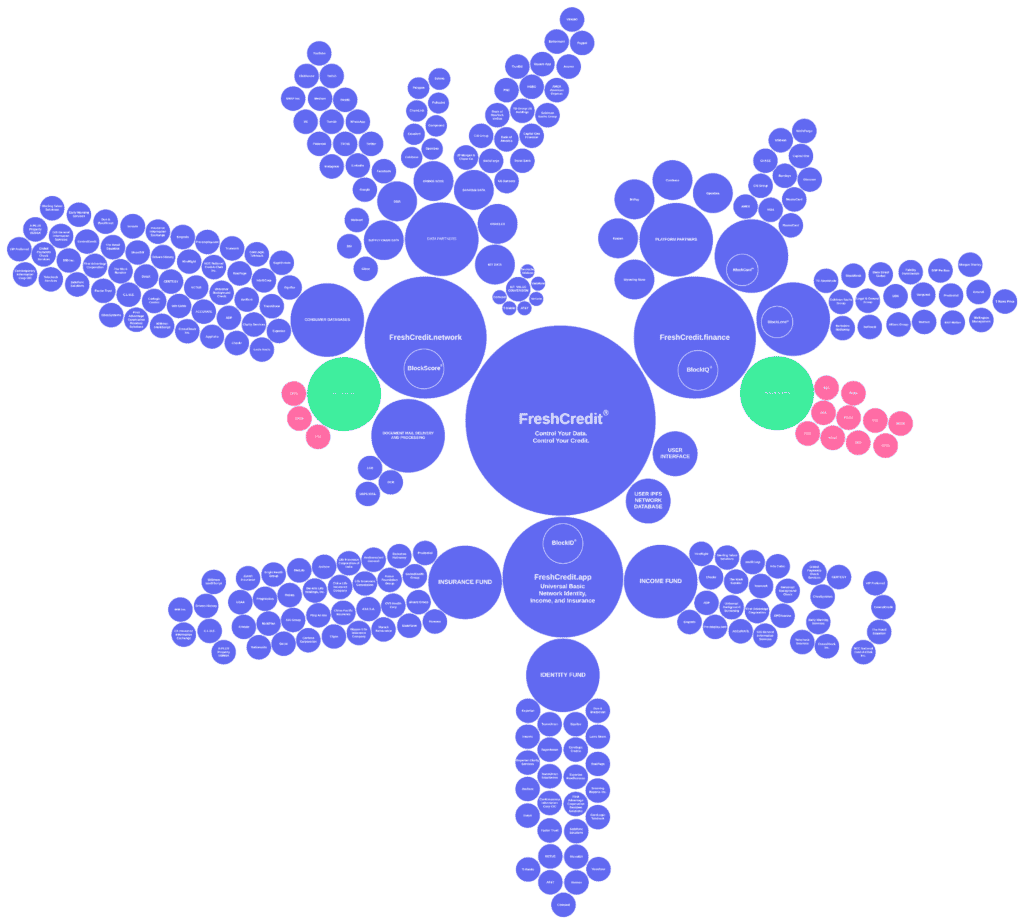

The Protocol Overview

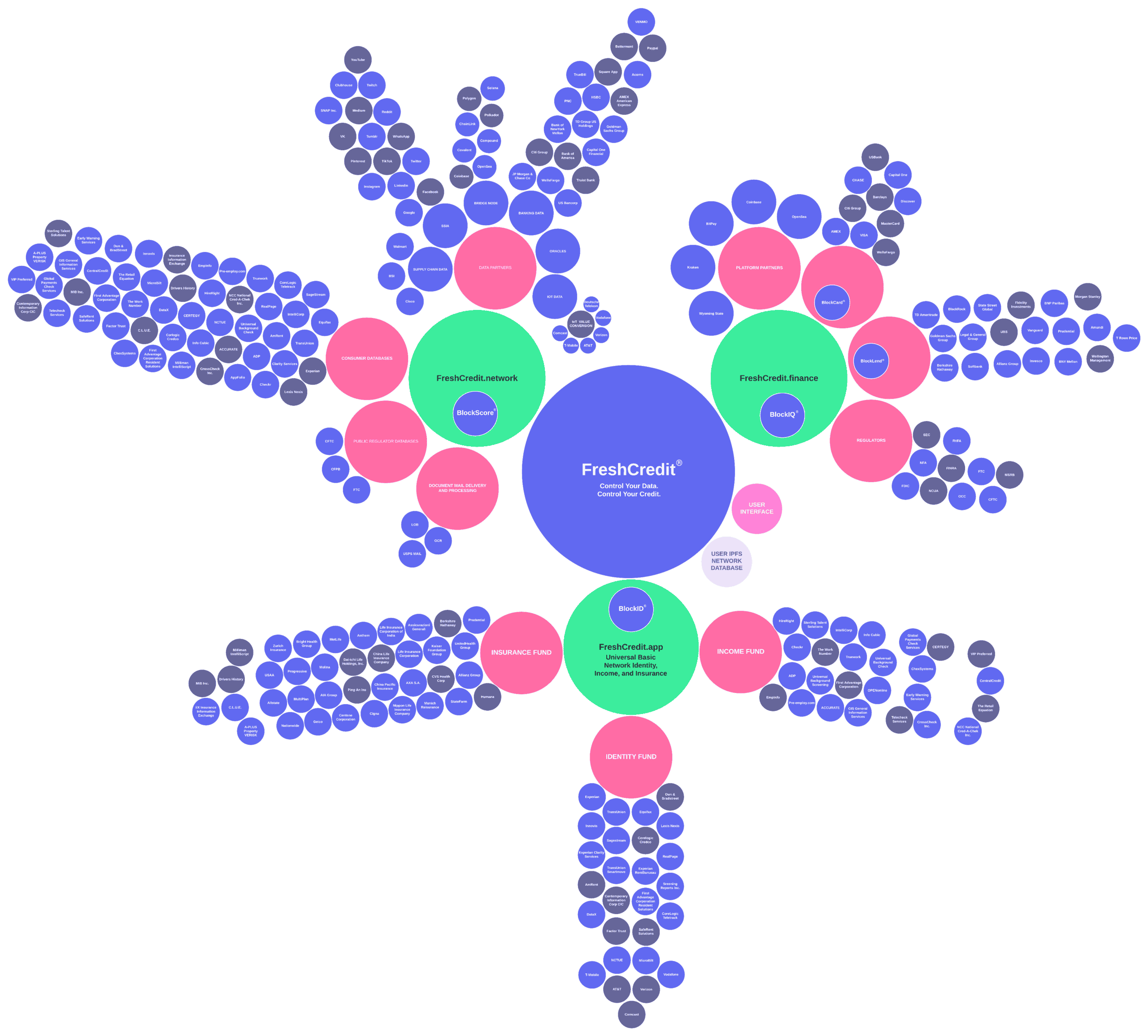

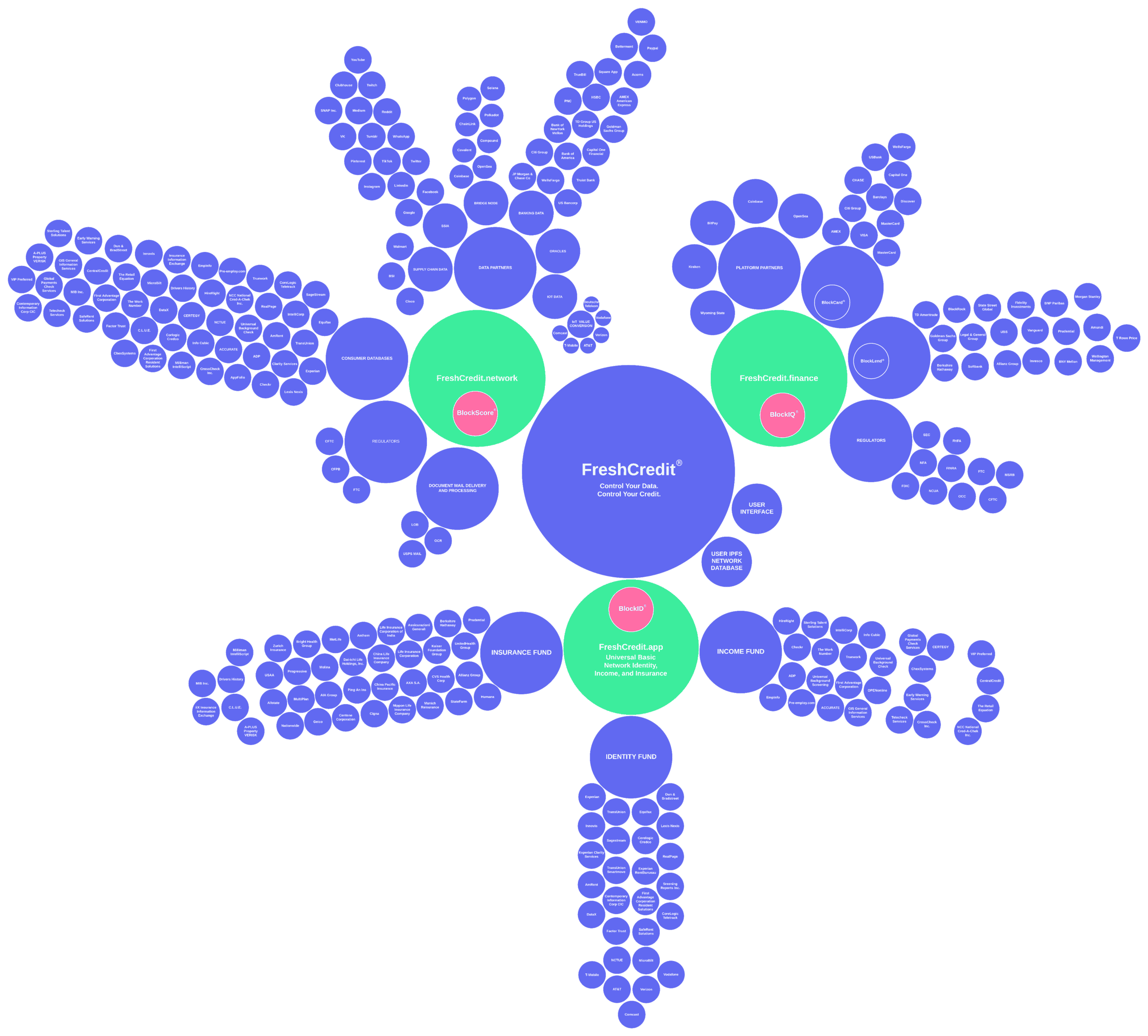

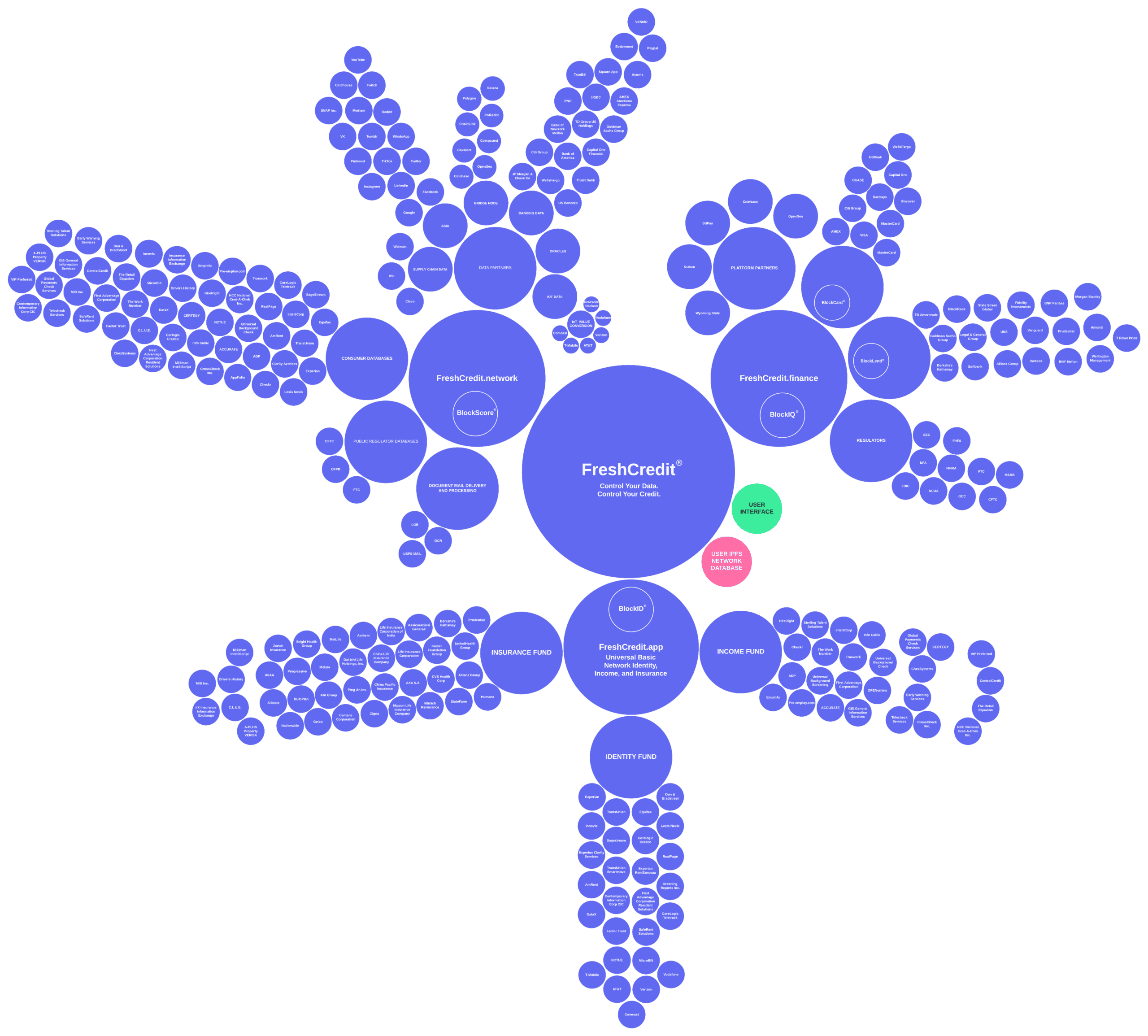

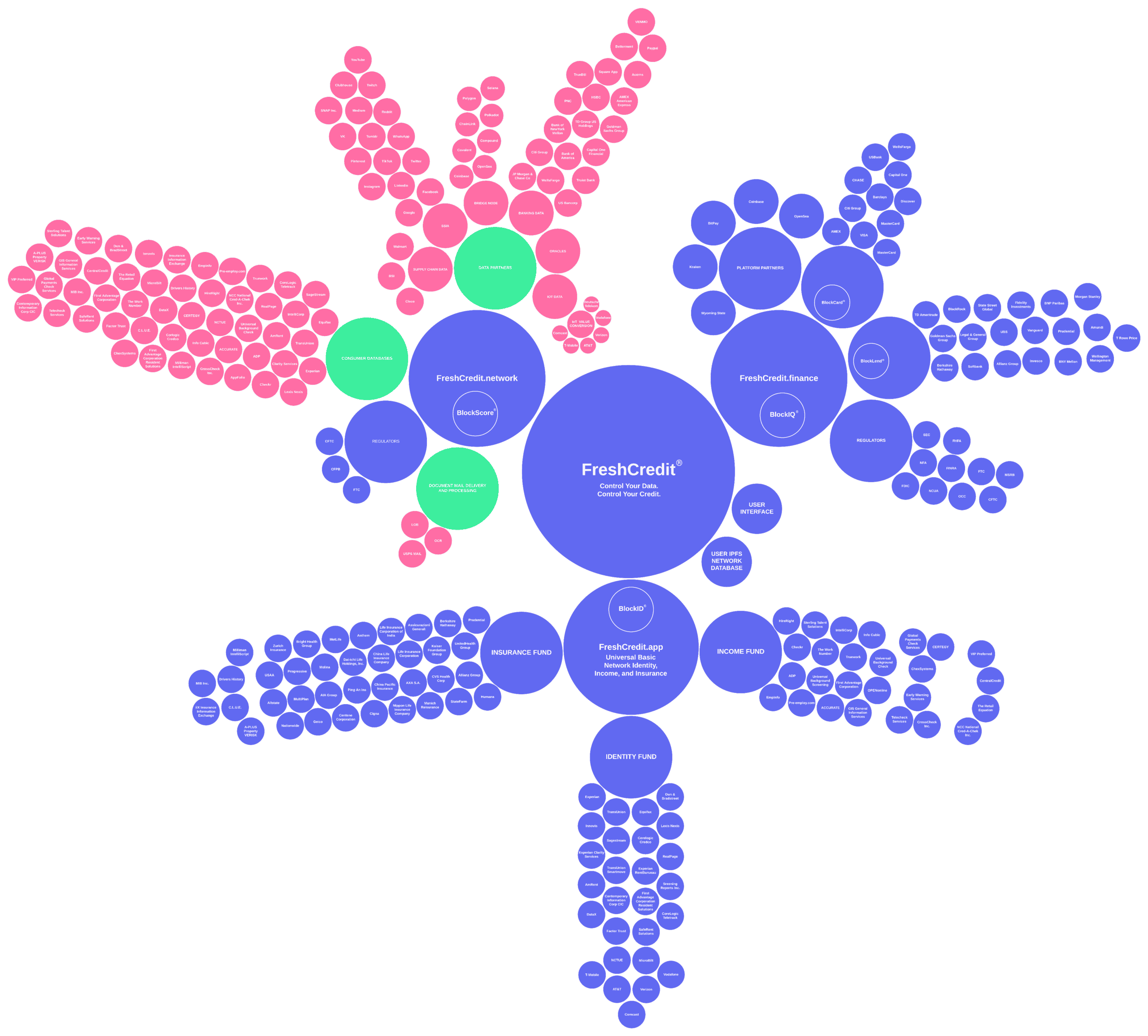

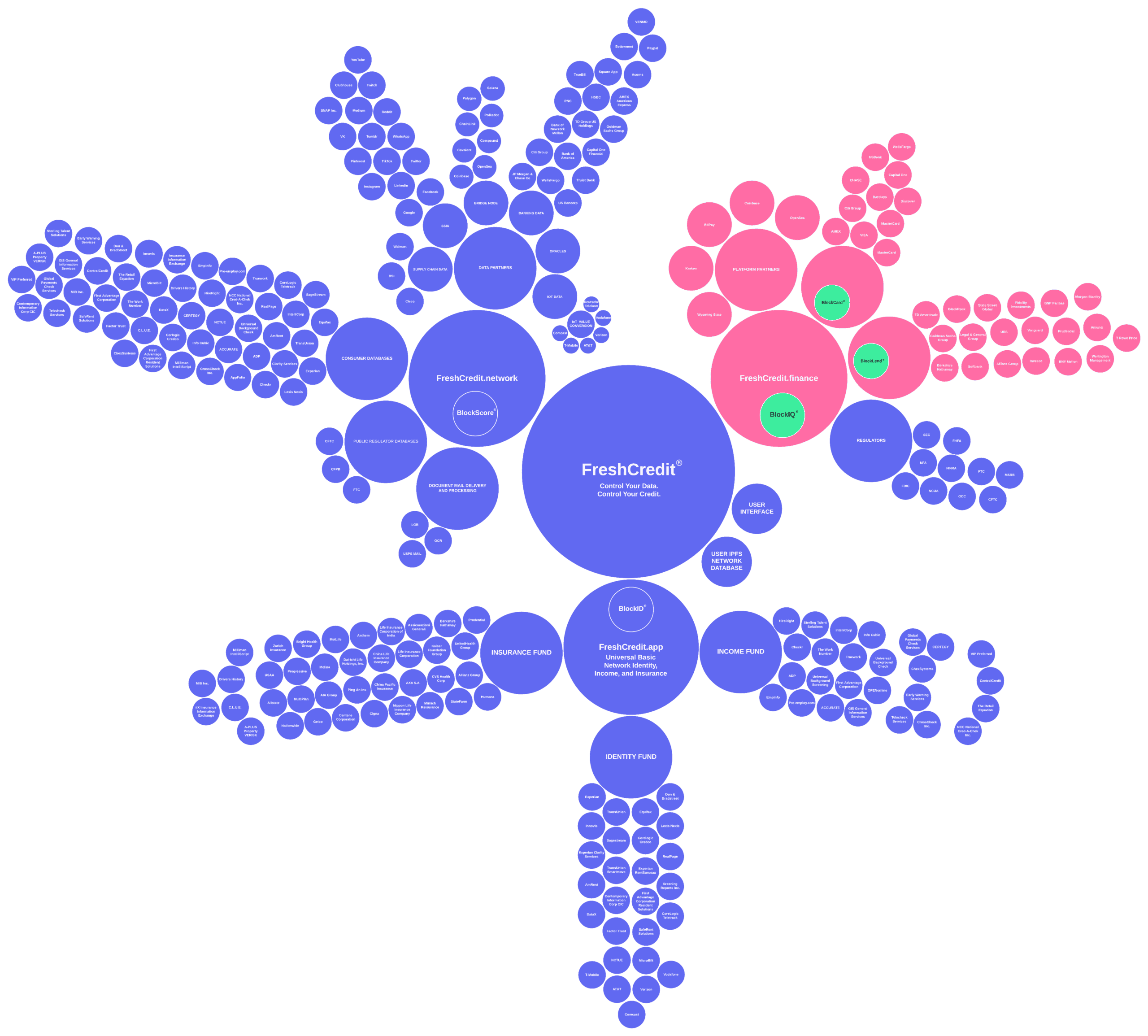

The Fresh Protocol is an algorithmic inclusive credit reporting, scoring, and lending protocol powered by the Substrate (Polkadot) blockchain framework and IPFS cloud infrastructure to securely connect to legacy financial networks such banks and credit bureaus while implementing inclusive alternative data establishing a much more accurate picture of the user’s financial identity and creditworthiness, allowing both centralized and decentralized institutions to extend credit to users operating in underdeveloped and immature markets without taking on additional risk.

The Fresh Protocol Components

There are three main components to The Fresh Protocol. The protocol improves the current credit scoring and lending systems by implementing composable inclusive scoring models that can serve emerging markets utilizing alternative data while maintaining the highest security and privacy practices blockchain technology provides and simultaneously allowing centralized and decentralized institutions to offer compliant, secure, and fair lending opportunities at a global scale.

BlockID® dNFT

This is the secure global financial identity allowing lenders to provide compliant lending options to consumers and businesses without exposing the personal or sensitive data of the user. The BlockID® NFT is a dNFT (dynamic NFT) that can be updated and altered over time alongside the network and be used to self-collateralize loans. A BlockID® dNFT is the credit reporting registry protocol tracking current and historical debt obligations tied to the user’s BlockID® dNFT.

BlockScore® Protocol

This is the standardized metric of the user’s creditworthiness. It is an unbiased, transparent, and decentralized scoring model similar to VantageScore or FICO while allowing the implementation of alternative data and economic models to more effectively complete the financial identity. This is governed by the non-profit organization, the BlockScore® Network.

BlockIQ® DAO

This is the transparent algorithmic protocol controlling the BlockIQ® DAO(decentralized autonomous organization), a non-custodial liquidity pool that generates value by tokenizing new data generated across the network, improving the BlockScore® Protocol’s overall accuracy affecting the loan interest and allocation of the BlockIQ® DAO. The BlockIQ® DAO allows assets to be staked to the liquidity pool utilizing a user’s BlockID® dNFT.

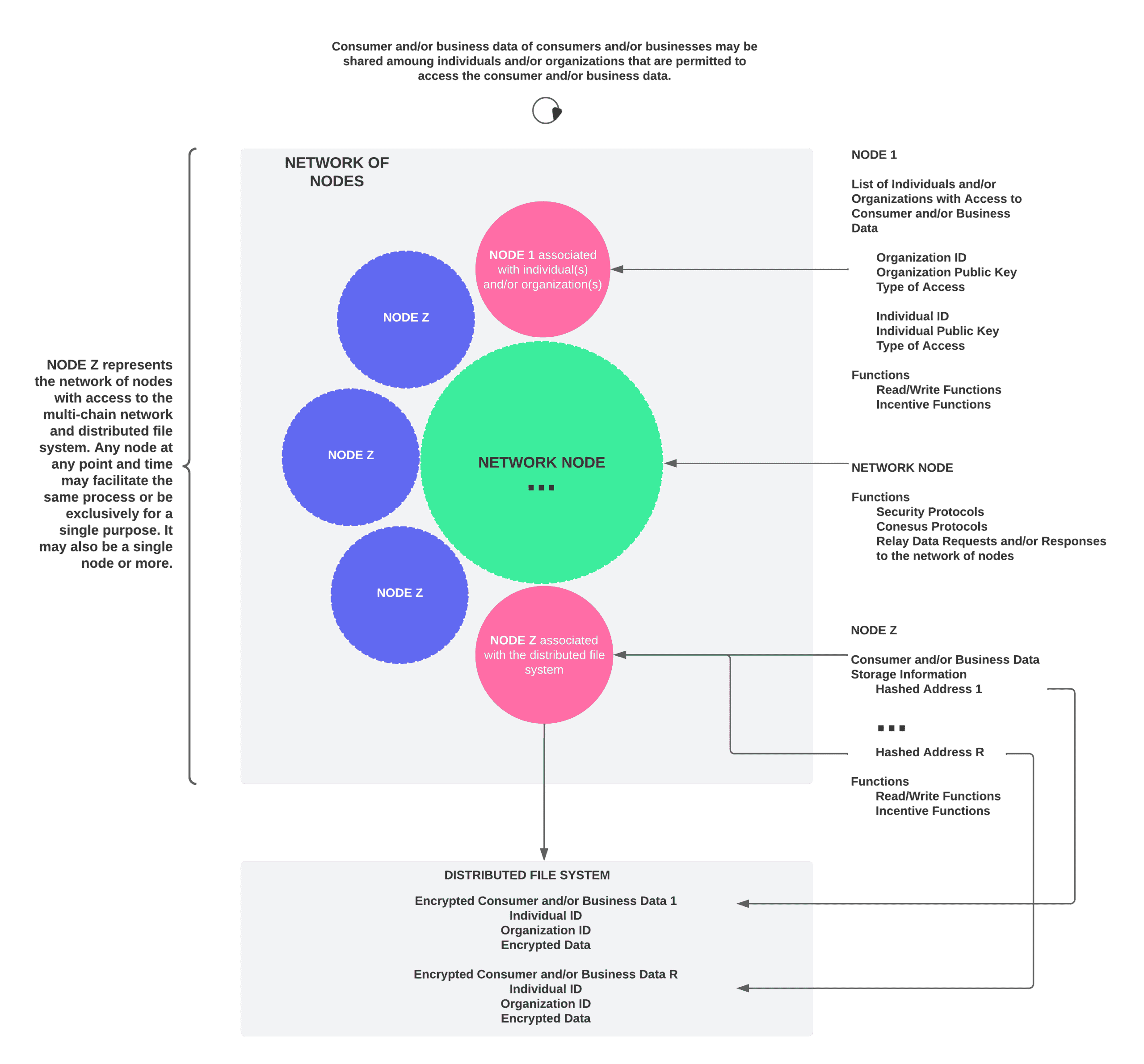

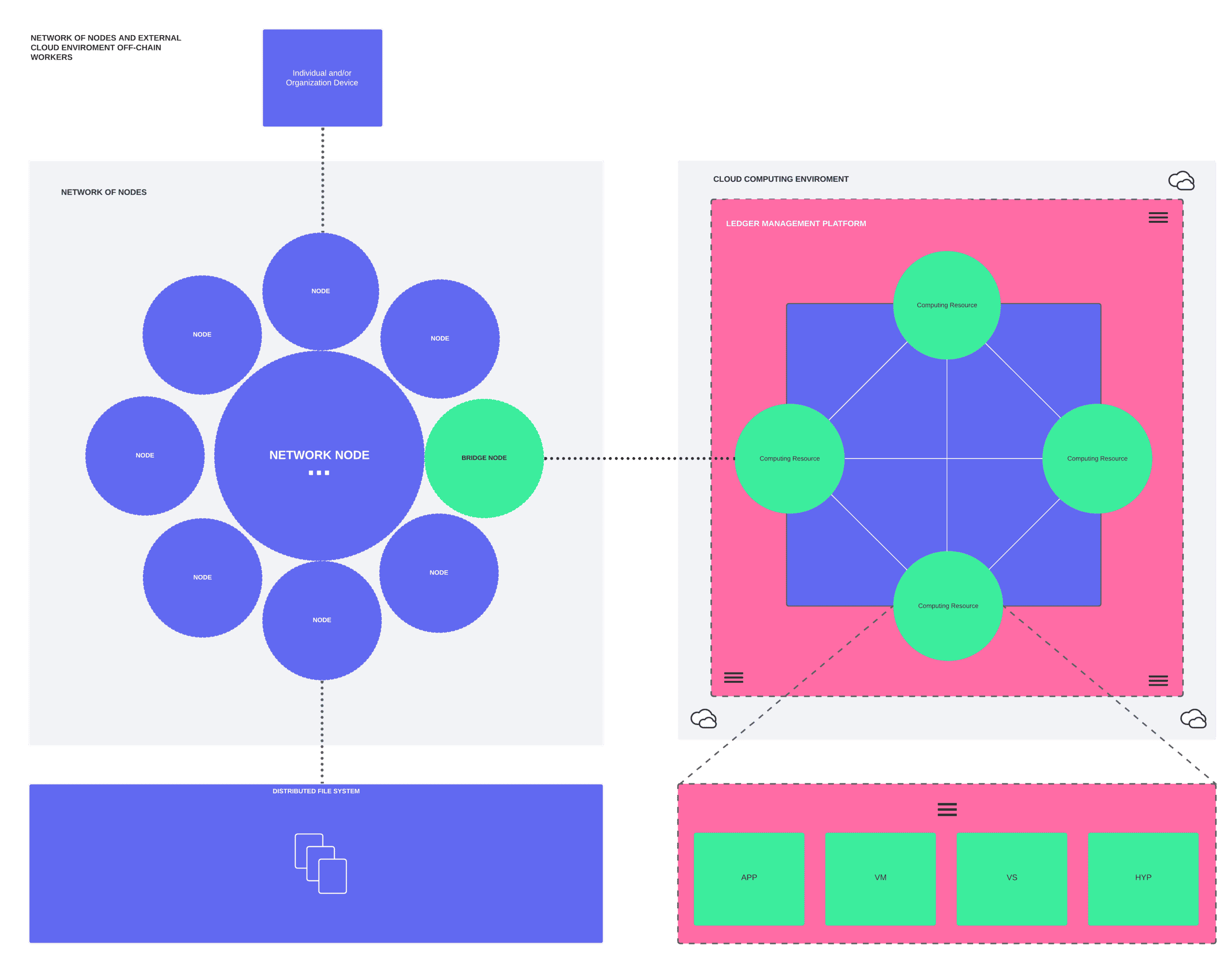

Architecture

The Fresh Protocol operates via a distributed cloud node network on the Polkadot blockchain utilizing parachain technology and side-chain operators. This allows interoperability to extend to all other blockchain networks in the decentralized ecosystem, such as Ethereum, Cardano, Stellar, and Ripple. The Fresh Protocols nodes use validators maintained on cloud-based infrastructures, such as Microsoft Azure, AWS, and Google Cloud, and this allows the nodes to connect to centralized institutions using off-chain operators.

The parachain’s validators then validate all the data reported by the side-chain operators before being cryptographically stored and analyzed by the composable open-source credit scoring algorithms.

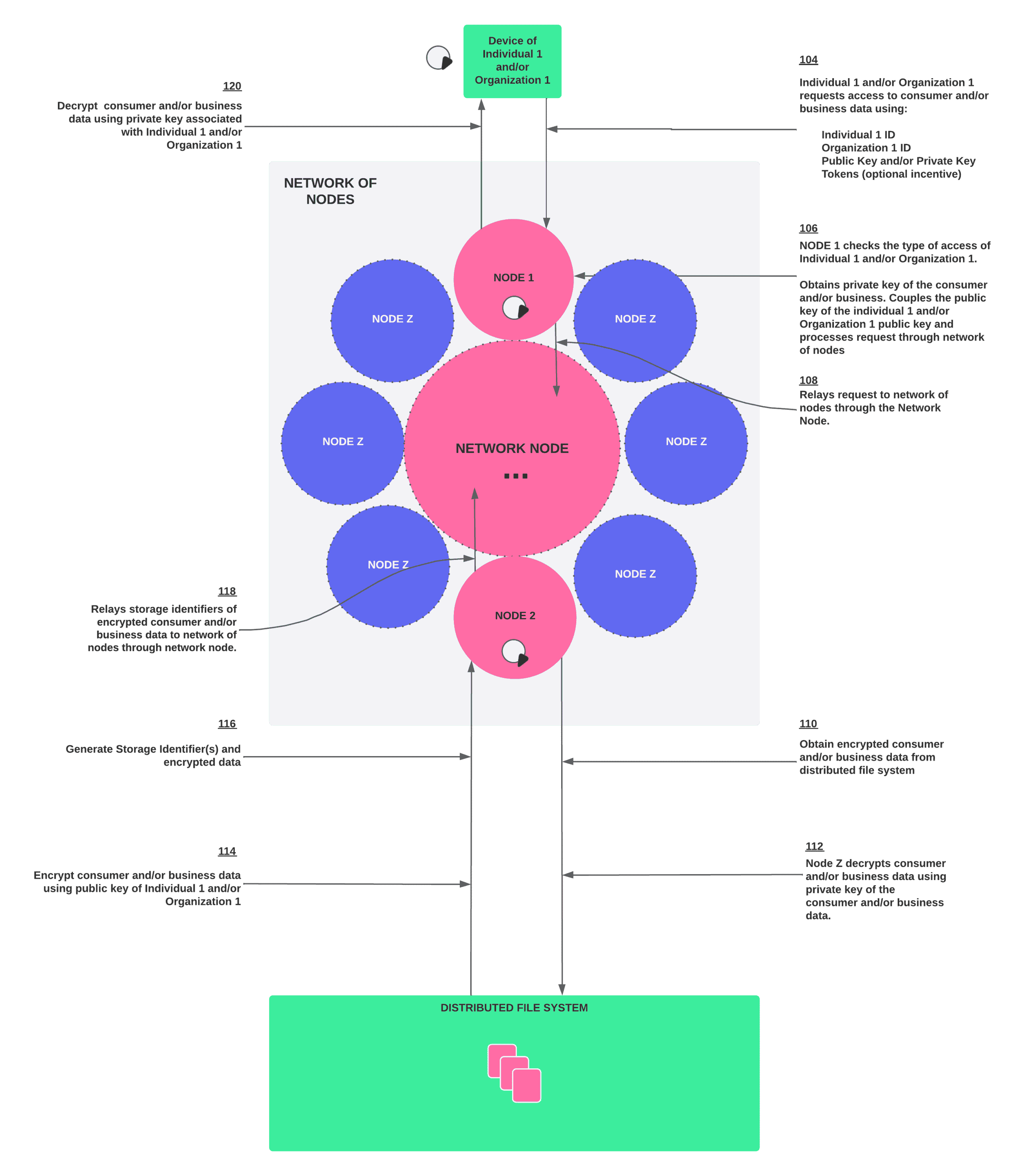

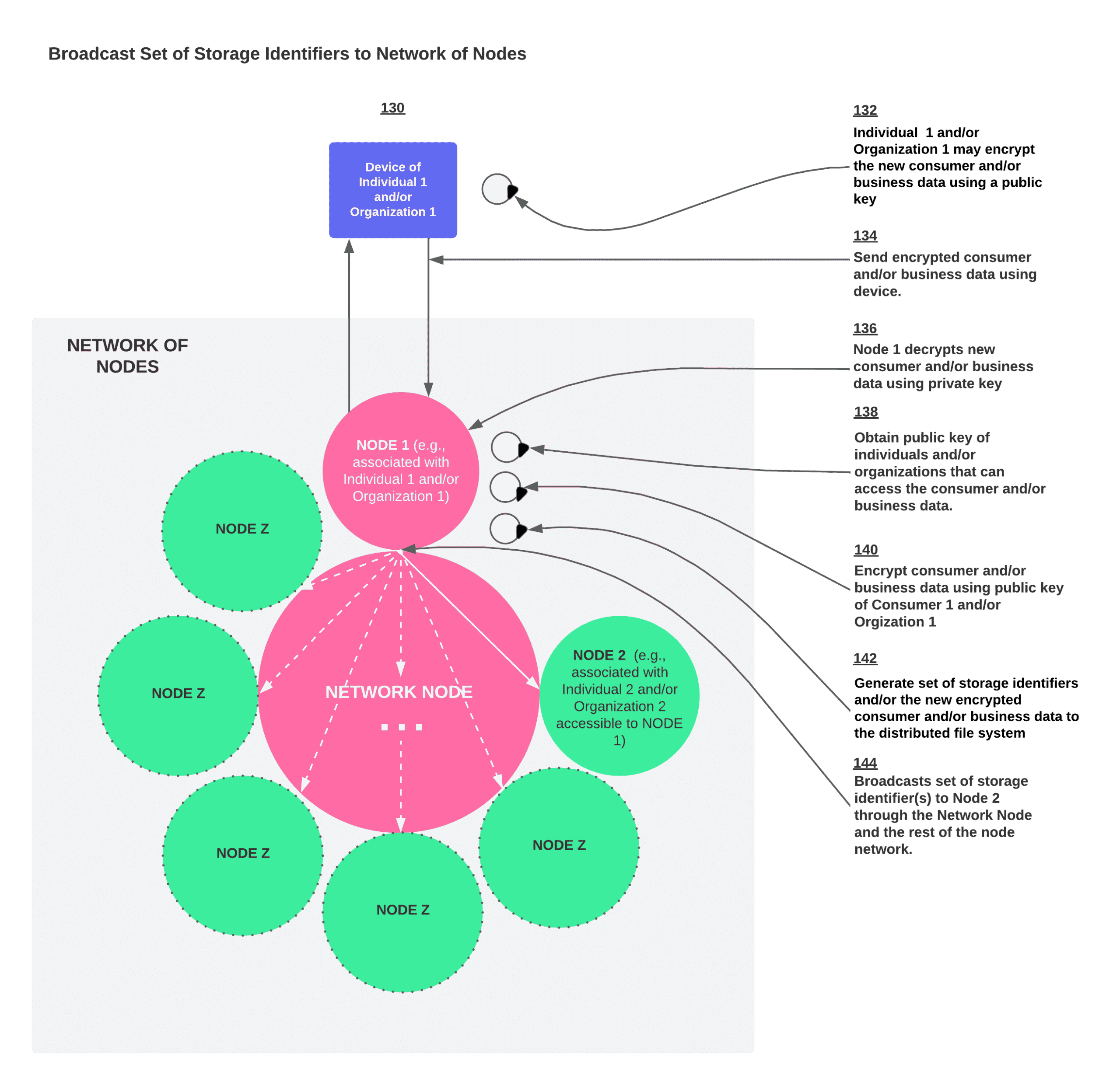

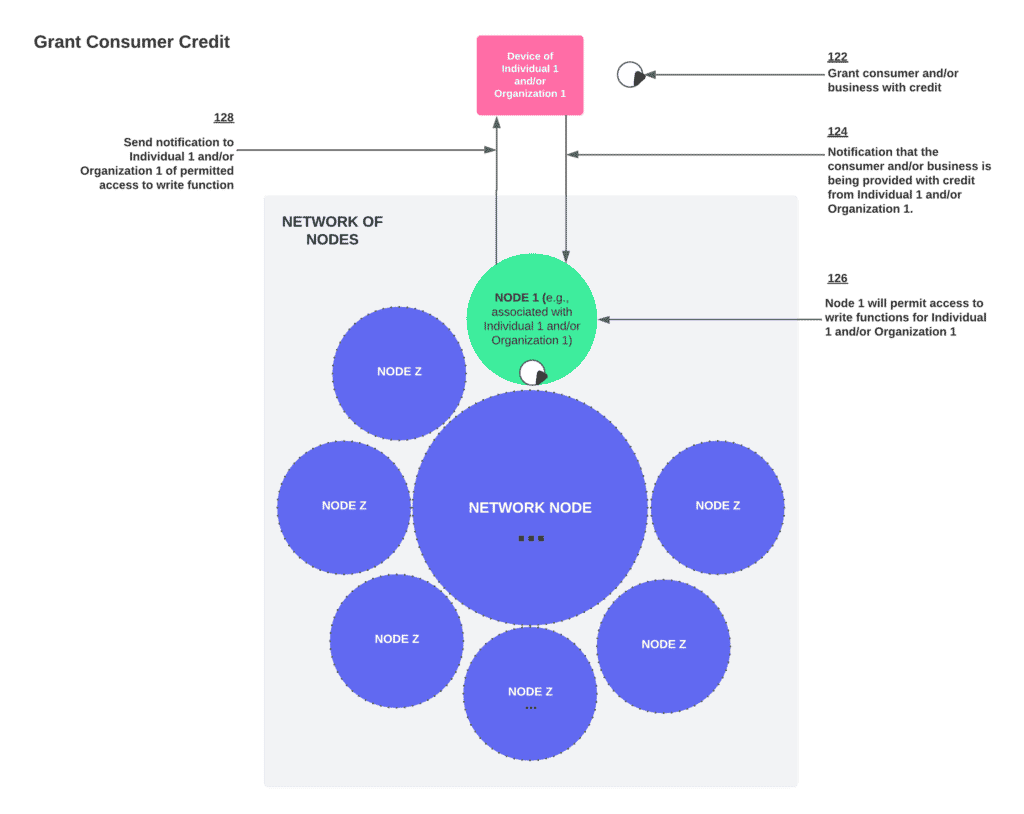

The BlockID® dNFT – Data Management Protocol DMP

The user’s BlockID® is the key and access point for the user to control and customize data sharing options that give the individual the ability to interact with their BlockID® and the data ledger, storing hashed versions of all the data captured on the network. This allows them to customize the amount and type of data they allow for analysis when they would like to monetize their data utilizing the network. User-specific data earnings are calculated and fractionalized from the total earnings generated on the monetization layer and stored on the earnings ledger before being distributed to each individual’s BlockID® dNFT wallet.

Sovereign Financial Identity and Data Control

A user’s BlockID® dNFT is a dynamic NFT that serves two core functions. First, it is the master key to the individual’s wallet contains a collection of keys generated by the data assets contributed to the network compounding over time. Second, it serves as the user’s profile, mapping the identifying factors of value generated by the data contributed by the user. In some cases, specific data may only be useful for a period of time or at another set time in the future. The user can then use their BlockID® dNFT as the key to access their data library to share this data and monetize it in ways not currently available in centralized and decentralized lending markets.

By accumulating more user data over time, the BlockID® dNFT will increase exponentially, contributing to the overall network value and vice versa. As the value of the BlockID® dNFT increases, the rewards based on user contribution to the ecosystem would simultaneously increase, incentivizing long-term engagement with the network. An NFT that maps specific user attributes and behavior that is interoperable or transferrable to another ecosystem benefits the entire network overall that is currently unavailable. It is the ideal means of transferring unique user data to flow from one network to the next.

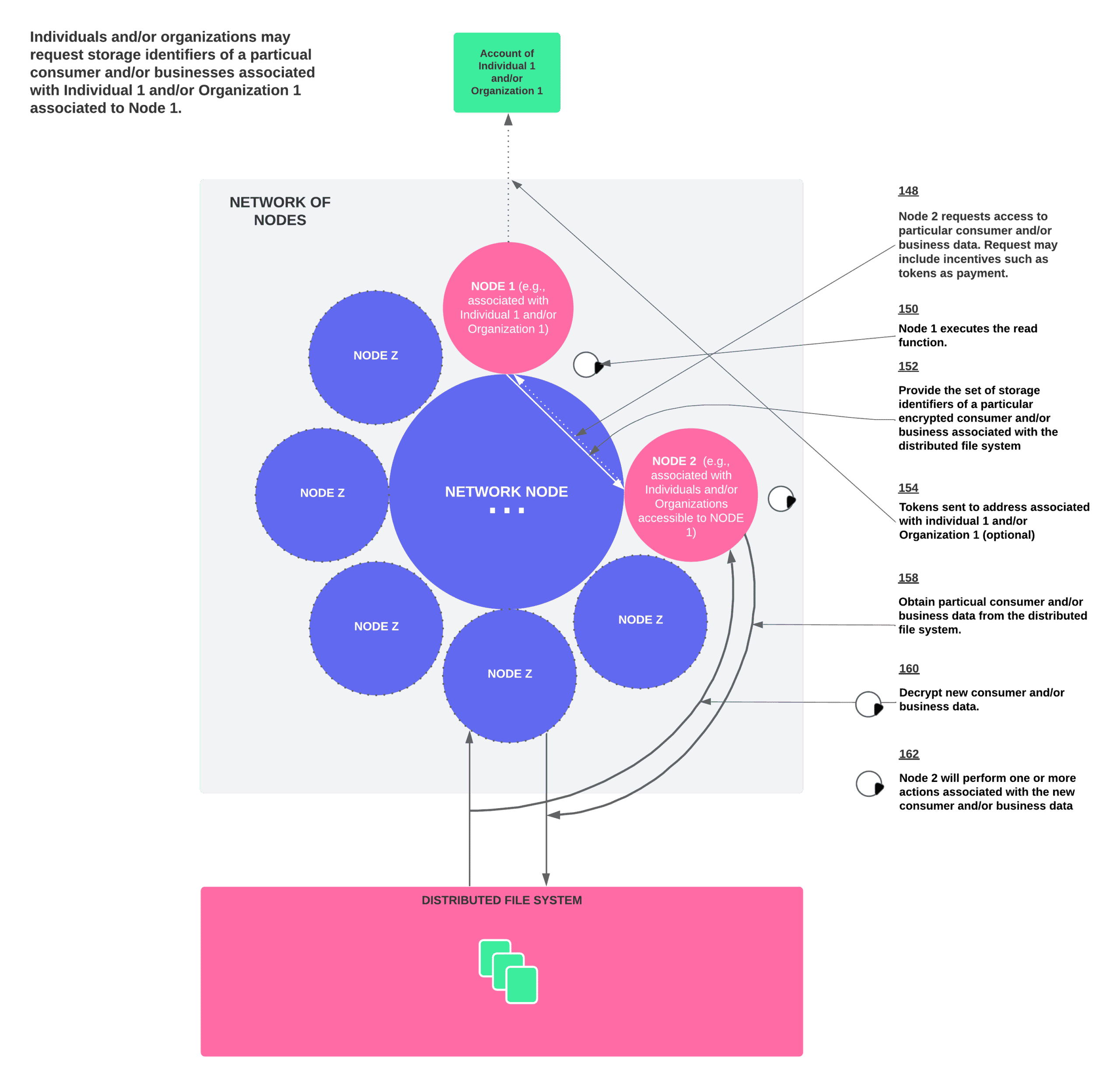

The BlockID® dNFT allows approved organizations that store consumer identities to identify a user and mark that information on the blockchain as valid. User data sources may include but are not limited to financial transactions, credit bureaus, income verification, and digital assets which have been staked or claimed to know wallets or devices in the network. This allows the users to inherit trust from their existing reputation or establish a new track record using alternative data. Every user on the network has complete control of the data that they provide the network, utilizing opt-in functionalities to share data through interoperable API-based data transfer networks. All whitelisted data providers are GDPR compliant.

Once a user’s data is requested and retrieved, the data provider cryptographically signs and returns it to the user creating a unique storage identifier. The data provider then sends access tokens to the user’s non-custodial wallet. This process maintains a one-to-one mapping from the user’s wallet to the user’s BlockID® dNFT and enables future retrieval of current user information.

Currently, private companies such as credit bureaus and governments hold most identity data globally. These organizations play a critical role in accelerating the user adoption rate of the BlockID® dNFT ecosystem by validating the authenticity of user-submitted data.

Identity Validators

The BlockID® dNFT supports many forms of identity validators.

Electronic ID Verification: Verification of a user’s identity data by cross-referencing provided information with public records, private records, or government databases from around the world.

Documentary Verification: Verification of official documentation such as a passport or a valid driver’s license and whether the user’s image on the document matches the provided documents.

Social Verification: Verifying the user’s identity via social networks like Facebook, Linkedin, and Twitter using open-graph technology to help reduce fraud.

Sanction Screening: Cross-referencing known global sanction programs operated by various governments worldwide to ensure the user is not listed on one of these sources.

Politically Exposed Persons: Ensure that a user is not someone with a prominent political function who could be at high risk of potential bribery or involved in political corruption.

The Fresh Protocol data is comprehensive first-party data that provides different dimensions and data sources in real-time. The network securely manages the data and processes that data based on the user’s permissions and privacy settings. This new model is the next giant leap in data monetization leading to the tokenization of data creating actual ownership of the user’s data granting access to the BlockScore® Network, on-chain governance, staking rewards, and new unseen streams of social capital.

The sourced data is filtered, segmented, and issued a storage hash key representing the user’s cryptographically stored data. These insights provide patterns that will maximize the credit scoring and matching algorithms accuracy, enabling the data management platform to offer a superior dataset that can be leveraged by financial service companies and institutions, allowing them to access, manage and create targeted segments on a global scale. The data ledger establishes an audit trail enabling the network to track how each specific block of data has been used. The privacy settings chosen by the individual user enable granular auditable traceability that allows the fractionalization of lending revenues generated by each user’s staked amount of monetized data.

Reporting Format

The BlockID® dNFT is a user’s dNFT (dynamic NFT) for reporting and tracking historical and current debt obligations tied to the user’s BlockID® dNFT. The BlockScore® Protocol allows the users to opt-in or out or release data to third parties through the public API.

The basic concept of the credit industry is sharing data. The cross-chain architecture of the Polkadot Substrate blockchain framework allows for rapid development of credit business scenarios, but data will be managed on the blockchain network. In order for The Fresh Protocol to securely integrate with centralized institutions and decentralized platforms, the current organizations must be able to report payment data in a consistent transferrable format. By doing this, The Fresh Protocol will utilize the existing building block and core credit data of both centralized and decentralized networks, forming a complete picture of each user.

Tamper Proof Reporting w/ IPFS

This format represents a payment agreement requiring a set payment amount for a set period of time. The information generated by the loan contract payments is encrypted and then pinned to the IPFS address of the user tied to their BlockID® dNFT.

Sharing A Report

This allows the user to interface the data with other network collaborators. When an organization accesses the shared data, they can confirm the original IPFS resource deterring against fraudulent reporting. The organizations or credit data producers will contribute information that is validated by the network that can be tokenized, forming a trusted digital asset that can be monetized or exchanged across networks.

Implementing FCRA Compliance

Node validation on the network confirms that the data transactions are accurate, and the blockchain ledger supports the auditable traceability of where the network is deriving value. The node serves to maintain the blockchain record. As the data is stored on a blockchain, this creates concerns for data privacy and the right to dispute unverified or inaccurate information. Blockchain is transparent and immutable, possibly exposing user data and, secondly, making it impossible to erase erroneous information. According to a study by the EU parliament, protecting credit data and enabling the ability to erase data can be accomplished utilizing a multi-level encrypted storage solution while still implementing blockchain and the IPFS network for off-chain cloud storage referencing the cryptographic hash generated by the users BlockID® dNFT.

In order for The Fresh Protocol to follow regulatory compliance standards of the Fair Credit Reporting Act, FCRA, and EU, which state must allow users to exercise the right to deletion from their credit report, the system requires a three key process. One key belongs to The BlockScore® Network, a second key belongs to the user, and the third key is algorithmically generated by the initial server that processed the data. This third key can later be used to destroy the data using the same algorithmic encryption correcting the credit report. It is essential to understand that this does not remove the immutability of the blockchain but instead allows the functionality of the network server to modify the data stored in the IPFS cloud network. This modification is then recorded onto the blockchain creating immutable traceability to audit how the correction was made.

Storage Cost On The IPFS Network

The cost to store 2-3 terabytes of data costs around $6usd annually, which is nullified further by the remittance fees factoring in-network data storage costs, meaning the user does not actually pay a subscription-based storage fee, reducing the barrier for entry.

Handling Bad Actors and Spam Accounts

Users will spend time building their decentralized BlockScore. Time connects financial accounts, social KYC, syncing credit reports, and blockchain transactions. These things take time to build up, and users cannot go backward and fabricate this data. If a user abandons a BlockID® dNFT and tries to start over, it would take a significant amount of time to build a BlockScore® without connecting external accounts. If users tried to connect previous accounts, they would simply resync to the previous score. Obtaining new government documentation, rebuilding entire social networks, blockchain activity, and institutional financial data with history provides a high level of scrutiny while disincentivizing the notion of abandoning an individual BlockID® dNFT and trying to restart or game the system.

The BlockScore® Blockchain – Data Scoring Protocol DSP

The BlockScore® Network is a transparent, decentralized blockchain supporting the BlockScore® Protocol is a dynamic indicator of an individual’s creditworthiness, adapting to the maturity of the user’s credit history whether they are new to credit or have been building for years. The credit algorithms can interact with the users’ centralized financial institution, alternative data providers via the side-chain operators, and on-chain assets and historical behavior to assess the risk of default before generating a credit score.

The BlockScore® Network is an inclusive credit scoring system for verified financial identity. The protocol allows users to establish a global, federated identity with third parties and whitelisted partners who “vouch” for their identity information, legal status, and creditworthiness. The BlockID® dNFT is the data management protocol for establishing a reliable identity and forms the BlockScore® Network of creditworthy users.

Network Data Input

The BlockScore® Protocol is an inclusive scoring model because it is standardized yet composable, providing open-source developers with an initial modular framework to build new credit scoring models. They can then propose new attributes for consideration, such as assets, organizations, and alternative data sources unique to each culture’s needs and regulatory demands through a process of network consensus. If the network approves the consensus, these additional attributes will be implemented to bootstrap credit scoring models that traditional scoring models may overlook.

This standardized credit risk protocol can be viewed as a prioritized set of global risk parameters. Using the technological advantages of the Polkadot/Substrate blockchain framework, new iterations of the credit scoring models do not need to fork, resulting in a new blockchain. Instead, they can continue to be part of the entire network, intrinsically providing more data for all parachain networks to utilize and benefit.

Oracles

Economic Data – Calculating economic factors in the credit score process can provide key insights and allow lenders to disentangle credit risk due to borrower idiosyncratic factors from broader external trends in the economy. By utilizing supply chain data to understand consumer demand to develop an even more fair, inclusive model to consider real-world needs. This can make getting access to crucial funds in parts of the world possible previously unreachable. Implementing economic credit drift for scenario-conditioned credit scores also provides a mechanism for lenders to communicate changes in risk profile more effectively to auditors, regulators, and other stakeholders as well as individual borrowers. According to a study done by Moody’s Analytics, not only is the probability of default of greatest importance to lenders, but it is also highly correlated with key economic indicators such as GDP growth and the unemployment rate.

Social Network Data – Research shows that borrowed credit score, the number of successes, prestige, the number of failures, repayment period, forum currency are the essential attributes for predicting the default. In these factors, prestige and forum currency are social network information, the repayment period is loan information, and others are credit information. The credit score is less important than the six other attributes. – Science Direct

Digital Footprint – Users give explicit permission to social data, digital footprints, and blockchain data can supplement when traditional methods like government docs, financial institution KYC, Etc., are unavailable. A study conducted by the FDIC using 250,000 observations using digital footprints suggests that a lender that uses data from both sources (credit bureau score + digital footprint) can make superior lending decisions compared to lenders that only access one of the two sources of information.

APIs

Blockchain Data – BlockScore allows users to access DeFi accounts by tracking their financial transactions and assets on multiple chains. Financial transactions include lending, borrowing, repaying debt, depositing in vaults, liquidity pools, cryptocurrencies, NFTs, Metaverse, IoT Devices, etc.

Financial Data – Currently, legacy credit bureaus generally only care if someone has unpaid utility or cell phone bills that have been turned over to collections agencies. Consumer-controlled and permission-based data could permit lenders to access their financial records for paying their bills on time. Instead of only being penalized for missed payments, a consumer could get rewarded for on-time payments.

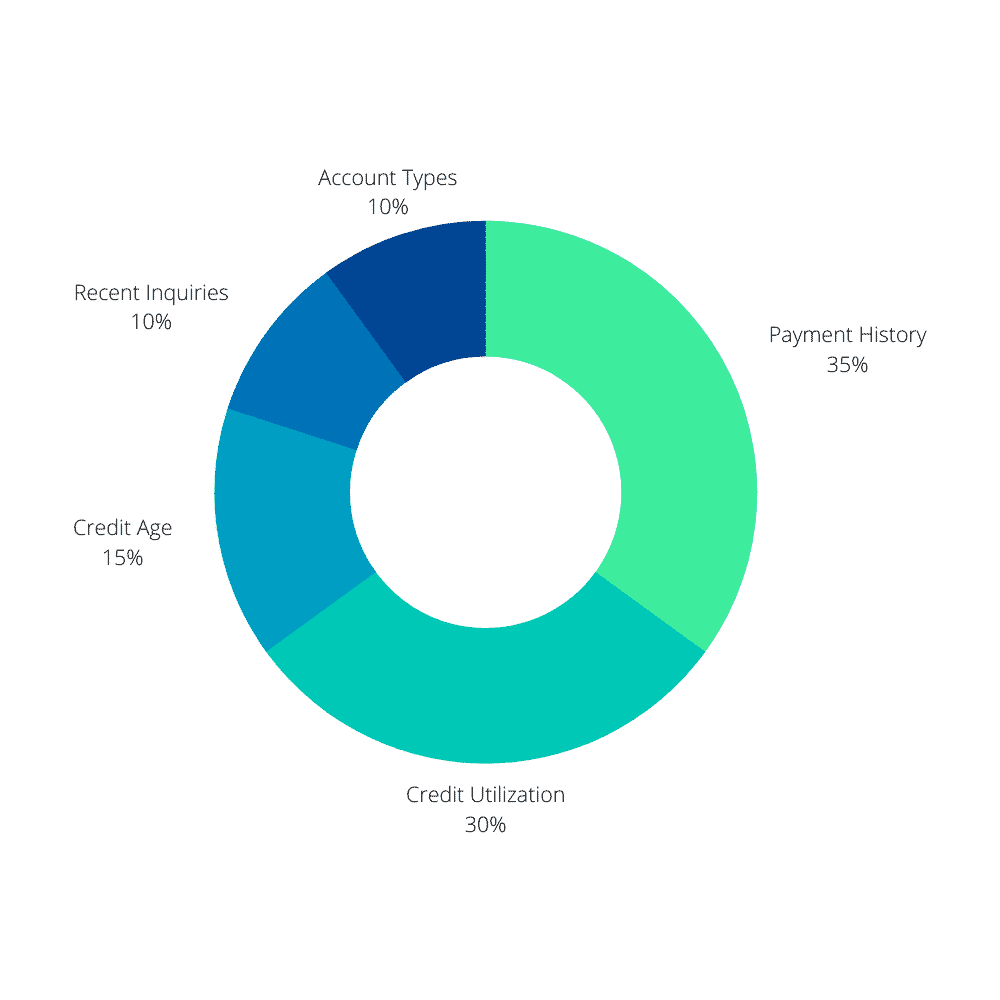

Credit Data – The following five factors are vital to achieving and maintaining a good BlockScore, no matter which score is being used. The percentages listed refer to how heavily these factors weigh into a consumer’s BlockScore®:

Payment History: 35%

Lenders want to see that consumers consistently pay their bills on time and that consumers pay at least the minimum required amount each time they are due. Even one late payment or missed payment can severely impact their BlockScore, so prioritize making payments on time and for the full amount.

Credit Utilization: 30%

This is how much of the total amount of credit available to consumers is being used. The rule of thumb is to keep credit utilization at or below 30% of their overall credit limits. For instance, if consumers have a total credit limit of $10,000 available, try to keep their balance below $3,000.

Credit Age: 15%

Everything else being equal, longer credit history scores better than a shorter one. To raise their score, even if an account has a $0 balance, do not close the account. As it stays on their record, it adds to their total available credit and the total length of their credit history.

Number of Inquiries: 10%

A hard inquiry occurs when a lender pulls their credit report in response to their request for credit, such as when consumers apply for a credit card or a car loan. A large number of inquiries in a fairly short time will drop their score dramatically, so make sure to do their due diligence ahead of time and only fill out an application when it is truly needed, or consumers are certain consumers can handle the responsibility.

Different Types of Credit: 10%

This factor displays a well-rounded credit history. Primarily, the mix will consist of revolving debt (credit cards) and installment debt (car loans, student loans).

Network Output

Algorithms

What Makes a Good BlockScore?

Perhaps the most straightforward answer to this question is if consumers pay all their bills consistently on time, keep the balance of revolving credit low, and only open new lines of credit when needed, consumers will have a good BlockScore®.

What Causes a Bad BlockScore?

There are several ways to hurt their BlockScore. As consumers may have guessed from the previous list, not paying their bills on time is one of the most common ways BlockScores suffer. People can make some common mistakes that result in a poor BlockScore, which include:

- Making late payments – Payment History

- Maxing out credit cards – Credit Utilization

- Applying for too many credit cards – Number of Inquiries

- Closing $0 balance lines of credit – Credit Age, Credit Utilization

- Refusing to use credit at all – Credit Age, Different Type of Credit

More things can negatively impact a user’s BlockScore credit. It is important to remember that inaction can have as much impact as a positive or negative action, so consumers must be proactive if they want to improve their BlockScore.

As the network grows, the users will help build and shape the new attributes that can be voted on and implemented over time.

BlockScore Range

There are various credit scoring formulas currently in use, but most operate on a scale of 300–850. Each credit score has its own scoring model on the same basic concept. The FICO score is the most commonly used scoring method maintained by the Fair Isaac Corporation. With BlockScore, the range will be 0-100. This is a globally understood range leading to faster adoption. Each level will include a cap based on data provided to prove an individual’s financial identity.

If a lender has ever pulled your credit report, there is a good chance it was your FICO score they pulled, as the FICO score is used by over 90 percent of all lending decisions made in the US. The BlockScore blockchain aims to change this centralized model that is auditable and immutable.

0 – 46 Bad

47 – 64 Poor

65 – 73 Fair

74 – 89 Good

90 – 100 Excellent

Of course, regardless of the label a consumer chooses to put on their score, the bottom line is that the higher their BlockScore, the more likely they are to be extended credit, and the less they will have to pay for it.

Methodology – BlockScore put the most significant factors in detecting loan default as the priority by combing traditional scoring models with social, economic, and blockchain data to create a fair and inclusive risk protocol.

Score Factors

Factor 1 – Financial Score (40-45%) – The ability to provide collateral and down-payments through multiple streams is crucial when building a credit history and financial identity in today’s economy. The financial factors influence the size of the loan and loan terms.

Factor 2 – Reliability Score (45-55%) – A study conducted at Stanford University shows consumers would care more about their credit score if it was not tied so heavily to personal income. Simply put, just because someone makes more income does not mean they are more responsible or trustworthy. Reliability is measured by past behavior, such as historical data that shows patterns of consistent financial decisions.

Factor 3 – Social Score (15%) – According to a study conducted by Carnegie Mellon, social metrics detect default with higher accuracy than credit scores. The study shows that consumers naturally put more weight on social situations good credit offers than the actual credit score itself. Further research done by Stanford University indicates that social data performs on the same level as traditional credit scoring methods and even outperforms in detecting loan defaults in many situations.

Off-chain Workers

The initial BlockScore® Protocol credit scoring algorithm will prioritize a specific set of risk parameters, a standardized set of global parameters for the network. The algorithm uses mathematical and statistical models using the input data to calculate the users BlockScore®. By storing the blocks of compiled data represented by cryptographic hashes on the data ledger, this data can then be used as the building blocks to train and increase the accuracy of the credit scoring algorithms on the network.

Apart from users, enterprise credit risk scores may also be used for rating traditional businesses, derivatives, hedges, obligations, AMM pools. This would help to increase trust and reputation in financial transactions for DeFi.

Public API

The massive upside for businesses is that the liability of holding user data is removed while tapping into a much larger data pool of richer insights and unseen potential utilizing the public API.

The cross-border analysis will lead to unprecedented discoveries of financial behavior and psychology, pushing businesses to create more essential services and develop products people need now. Contrary to popular belief, peace is more profitable than war, and war depletes massive resources and leaves the global economy off balance. Global supply-chain data supports the fact that blockchain can greatly increase the consumer business relationship while simultaneously on an enterprise level, enabling improved global coordination between lending partners and aiding access to financing.

The user data is stripped of personal details and cryptographically stored in a decentralized cloud network where companies who have requested network access to the public API can utilize user data on a micro or macro level to help them build better products and services. This removes any liability and most of the reasons for hackers to target a company while giving them access to better metrics for free while users and businesses receive value in return for the data they provide, which makes the network work more efficiently.

The BlockIQ® DAO – Asset Monetization Protocol (AMP)

The Value of Big Data

What do the 1% and the unbanked have in common? Data. Mountains of it. To be exact, globally, we produce 2.5 quintillions bytes of data every day. Data has many unique properties. It does not deplete or deteriorate. It is detailed in its context and used strategically to remain relevant and viable. Data can also be used and re-used for multiple purposes in parallel. What makes data a truly unique asset, unlike most other assets, which have a limited supply driving up the value while simultaneously bottlenecked by the physical aspect of economic output as people can only produce so much, but the more valid data we can produce, the more valuable the data becomes.

Users give explicit permission to use data sources such as social networks, digital footprints, and blockchain data which can supplement traditional KYC methods such as government docs, financial institution verification, credit data, Etc. Economic averages based on demographic and geographic details provide regulatory data for a verified detailed financial picture: the more data, the more precise and accurate the scoring protocol. A global credit scoring protocol allows value to flow between markets with less friction. A 2013 Stanford study shows the adoption of credit scoring enabled the auto lending industry to increase profits by a minimum of 42% per downpayment per subprime loan and decreased the average application time from 5-7 days to 3-5 mins.

Data fulfills the definition of an asset by IFRS and even by OECD standards.

“An asset is a resource controlled by the entity as a result of past events and from which future economic benefits are expected to flow to the entity.”

The more we do with data, the more the marginal costs flatten, and economic value grows. If the economic value of data in terms of marginal cost and value work that way, then the liquidity pool would, in fact, work that way.

As every user provides first-party data to the network, increasing the efficiency and accuracy of the overall credit scoring model, whether that data is positive or negative, that user’s BlockID® dNFT appreciates value simultaneously with the network. The user’s BlockID® dNFT. The more data the user provides the network, the more valuable their dNFT becomes. The longer the BlockID® dNFT is active on the network, the more it matures, increasing the total tokens connected to the user’s dNFT’s contribution allowing the user to capitalize on their direct involvement with the network.

Leveraging The Value of Big Data

As users submit data for verification, they generate tokens in the BlockIQ® DAO (decentralized autonomous organization), a self-sufficient infinite liquidity pool where users are able to either claim or stake their tokens using their BlockID dNFT.

By leveraging data, credit scoring, and blockchain technology, users own and monetize the value of their data using their BlockID dNFT(dynamic NFT) as it is updated over time.

Stimulating Real vs. Financial GDP

The central bank can print money, but it can only buy financial assets with those funds. The central government cannot print money but can buy goods and services. These two networks are co-dependent, so one does not monopolize the financial machine. The central bank can extend credit and print money at almost 0% and fulfill its purpose of stimulating the global economy. In order to drive real GDP, we cannot simply give value away “print money.” Initially, new value has to pour in from other sources.

To create more real wealth, people have to be more productive. The only way to do that is to give more individuals access to the global economy. A recent study conducted by The Institute for Policy Studies and New York Comptroller found that every dollar given to a low-income earner generated $1.21. That same dollar is given to a high-income earner only generates $0.39 for the GDP. Why? People with more money tend to spend less and save more on average. The luxury market is massive, but only a tiny fraction of the global consumer and enterprise demand.

Naturally, consumer accounts will accumulate at a higher rate, while enterprise accounts will accumulate lower rates as a naturally thriving economy functions. Utilizing these unique attributes of data, blockchains, and DAOs, we are able to provide a fair exchange of value for user data which is used in parallel to build a transparent, inclusive, fair credit and lending system for the other 96% of the world.

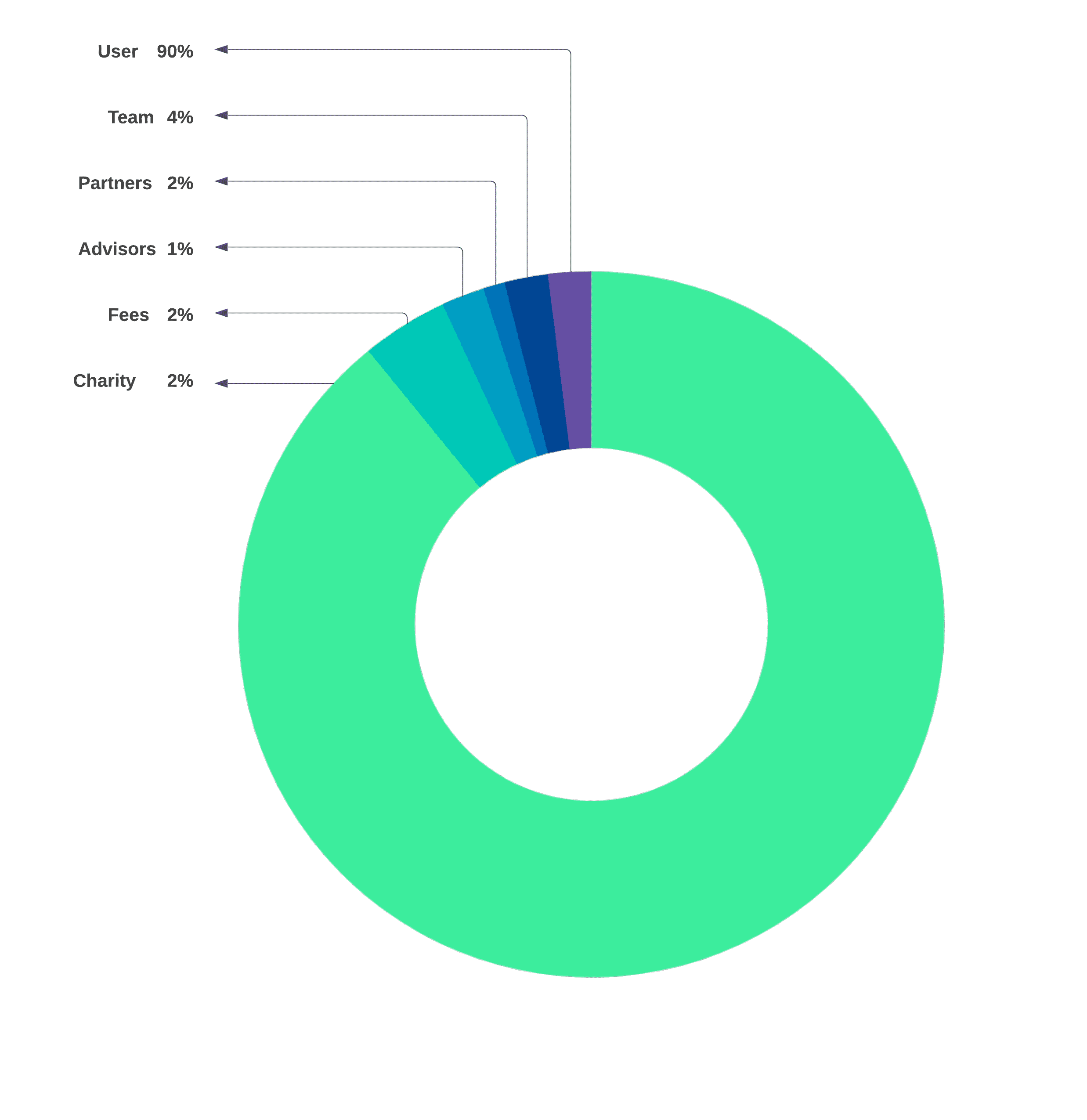

Token Dynamics

Utility

The FRESH Token is the native currency of the network and external platform interactions. The utility of the token is separated into four core functionalities.

- The token’s first function is the authentication and activation of a new user’s BlockID® dNFT.

- The second is to transmit value across the network as a settlement currency for contributed data and staked assets.

- Third to act as a means of exchange when bridging to other networks.

- Lastly, as a reward token granted to network users, validators participating in staking or supporting the network.

Removing friction from the data asset will enhance its liquidity and increase its perceived market value. The FRESH token serves as a representation or receipt of the user’s contributed data. This, in turn, allows fractionalization and remittance of the value created on the network based on the user’s contributions. Without tokenization, we cannot build a network of monetization. Without a unique user dNFT, the BlockID® dNFT, the user would be unable to claim their FRESH tokens. Each layer provides functionality to the network that would otherwise be impossible to encapsulate, tokenizing and monetizing a user’s data in the ownership economy.

Replacing the need to pay for data with the value of the data itself by tokenizing the data using parachain technology generating tokens representing a fractionalized value in the liquidity pool. The value of the pool grows with the amount of verified data being synced with the network. The data increases the accuracy of the deep learning algorithm, which is transparently governed adjusts the globally standardized scoring protocol. Constantly providing new data to the network changes the distribution of tokens and interest rates automatically and organically. When they adjust, they communicate with the BlockIQ® DAO, algorithmically processing network transactions.

As the token rewards earned by users for providing data to the network will be above 0%, we can remove a majority of the long-term risk of loan default by utilizing the interest from the tokenized data to eventually pay off any extended line of credit given enough time. The line of credit with the BlockIQ® DAO will dynamically adjust based on the user’s BlockScore and staked tokens, rather than going through the process of requesting limit increases or refinance options.

Staking and Earning

Users can earn more interest on staked tokens, including the new data they introduced to the network. The user can then choose to stake their BlockID® dNFT to lend token to the network liquidity pool, which The BlockIQ® DAO (decentralized autonomous organization) governs, in return for a higher interest payout.

Staking and Borrowing

Suppose users borrow assets from the network liquidity pool by staking their BlockID® dNFT. In that case, their network data interest for the data they contribute can be used to pay off the interest + principal over time, nullifying defaults and stabilizing the pool for the long term—creating the first self-collateralized loans.

Default Risk Protocol

Users may be requested to provide a small amount of liquidity in advance and stake their BlockID® dNFT interest payouts to guarantee the loan repayment. The ability to opt-out data and collect future interest payouts will resume once the user has paid back the debt. The debt can be paid back quickly or over time by the interest generated from the BlockID® dNFT maturing as it continues to provide data to the network’s overall credit scoring model.

Doing this guarantees repayment of the loan provided to the user, meaning the user’s debt is always paid, securing the network and allowing the network to offer the lowest possible fees as the risk of repayment is no longer as significant a factor.

Interest and Loan Terms

Loan terms and interest rates are influenced by but not limited to the users’ BlockScore® Protocol, available collateral, preferred term length. These dynamic interest rates adjust as users improve their BlockScore® Protocol, making it a more efficient, fair, and beneficial economic process. Governance over this process will be transparent with fair market practices in place protecting network users that can be adjusted at the request of the BlockScore® Network.

Compliance and Liability

The DAO is algorithmically controlled by the BlockIQ protocol and legally registered operates in Wyoming, US, where digital assets are recognized as legal property allowing the DAO to operate under current regulatory standards with clarity remaining compliant. Utilizing blockchain technology, the DAO is able to fractionalize the value of the liquidity pool in the form of rewards, credit, loans, and settlement.

The network collects remittance transactions. Validators collect on validating incoming data, and businesses collect a percentage of the tokens in exchange for their data. Users collect the majority of the token rewards generated from the data even if a third party provides that data as it is the user’s asset.

Conclusion

Re-framing data into a human context is critical. There are multiple things we can do to make data more human and, in doing so, generate much more value now and in the long term.

People need to experience the benefits of data ownership. While everyone in our society produces vast amounts of data, individuals rarely see or interact with any of it. When people are given tools to store, visualize, and explore their data, they will begin to understand the worth and utility of their data. Applied on a broad scale, it could lead to better decisions by individuals and businesses— both in cases where their data is being misused and in cases where data can be applied to solve significant problems like disaster response, medical breakthroughs, and scientific discoveries.

We need to have more inclusive, open conversations about the ethics of data management. There will be a tremendous benefit for companies who position themselves as “data humane.” In time this could be the standard practice for businesses as consumers become data-savvy.

Finally, we need to change how we collectively think about data as a new kind of resource. Consumers need to foster a deeper understanding of how their data benefits society. Humanity has an internal mechanism for this kind of broad cultural change: the arts. As we proceed towards profit and progress with data ownership, we must encourage artists, novelists, performers, and poets to take an active role in the conversation about data and digital assets. In doing so, we may avoid some of the mistakes we made with the old oil.

The Fresh Protocol provides solutions for some of the most complex problems currently thwarting big data, credit, and blockchain from being used to positively stimulate global economic growth and commerce long-term. By accomplishing the initial stages of building, this network user is presented with the idea of partaking in a potential multi-trillion dollar market.

References

- Fraud up 38% in 2020, FTC*

- Security Issues w/ Holding BigData*

- Value of BigData, Harvard Business Review*

- History of Credit Protocols (ledgers, bureaus, scores) – TIME Magazine*

- Discrimination – National Consumer Law*

- Issues w/ Social Network For Credit Scoring – Penn State*

- The Unbanked – Deloitte*

- Liquidity Constraints for Subprime Lending w/ Imperfect Information – Stanford*

- Credit Data – Modern Credit Scoring Affect On Lending Down Payments and Defaults- Stanford*

- Defaults 35% of loans default in the 1st year*

- BigData vs. BigOil – The Economist*

- The Data Revolution – Stanford, NBER*

- NFT Projected Growth 185% $485B by 2026, CAGR*

- Blockchain Projected Growth $2.2T by 2026, CAGR*

- Poll Rust Most Loved language – Stackoverflow*

- Web assembly compiler able to be any language vs. solidity community*

- Data Is An Asset – IFRS and OECD Standard*

- Rust is the safest and fastest programming language*

- Give $1 to a Poor vs. Rich effect on GDP – Institute for Policy Studies, New York Comptroller*

- Macroeconomic Effects of UBI $1000 13% GDP Increase – Roosevelt Institute*

- DeFi projects grew 385%, according to DeFi Pulse*

- Credit is Trust – FED, UCLA, Brookings Institution *

- Wyoming State Law on Digital Assets*

- Wyoming State Law on DAOs* –

- https://sos.wyo.gov/Business/Docs/DAOs_FAQs.pdf

- https://www.wyoleg.gov/2021/Introduced/SF0038.pdf

- Polkadot Whitepaper

- Gemini Trilemma

- Ray Dalio Economics

- Bitcoin Whitepaper

- Ethereum Whitepaper

- CAP Theorem

- Roosevelt Public Asset Manager

- 4% of the world is generating 24% of the GDP

- Americans have 50T in credit vs. 3T in cash

- Plaid fintech

- Plaid ACH

- Plaid refrigerator

- Effect of credit scoring TransUnion

- The Supply chain industry is worth $50T

- Plaid Beyond the Credit Card

- Psychoactive effects of credit

- accuracy of social media credit scoring

- Building A Transparent Supply Chain – HBR – https://hbr.org/2020/05/building-a-transparent-supply-chain

Disclaimer

This whitepaper is for information purposes only. BlockScore® Network does not guarantee the accuracy of or the conclusions reached in this whitepaper, and this whitepaper is provided as-is. BlockScore® Network does not make and expressly disclaims all representations and warranties, express, implied, statutory or otherwise, whatsoever, including, but not limited to:

(i) warranties of merchantability, fitness for a particular purpose, suitability, usage, title, or non-infringement;

(ii) that the contents of this whitepaper are free from error; and

(iii) that such contents will not infringe third-party rights.

BlockScore® Network and its affiliates shall have no liability for damages of any kind arising out of the use, reference to, or reliance on this whitepaper or any of the content contained herein, even if advised of the possibility of such damages. In no event will BlockScore® Network or its affiliates be liable to any person or entity for any damages, losses, liabilities, costs or expenses of any kind, whether direct or indirect, consequential, compensatory, incidental, actual, exemplary, punitive, or unique for the use of, reference to, or reliance on this whitepaper or any of the content contained herein, including, without limitation, any loss of business, revenues, profits, data, use, goodwill or other intangible losses.